Educational content

Get a better understanding of the banking and financial environment through these short educational videos

23

Nov

2021

Is Hydrogen the key to unlocking net zero?

Quite a topical question, but before answering it, let’s look at the fundamentals of this element. What is hydrogen and...

Quite a topical question, but before answering it, let’s look at the fundamentals of this element. What is hydrogen and...

Supporting the economy

Quite a topical question, but before answering it, let’s look at the fundamentals of this element. What is hydrogen and what makes it green?

Is Hydrogen the key to unlocking net zero?28

Feb

2020

16 - What is an ETF?

An exchange-traded fund (ETF) tracks benchmark indexes like the CAC 40. ETF managers do not have to pick between...

An exchange-traded fund (ETF) tracks benchmark indexes like the CAC 40. ETF managers do not have to pick between...

Banktionary

An exchange-traded fund (ETF) tracks benchmark indexes like the CAC 40. ETF managers do not have to pick between different stocks; they just follow the index according to its composition. ETFs are traded on the market just like shares.

16 - What is an ETF?28

Feb

2020

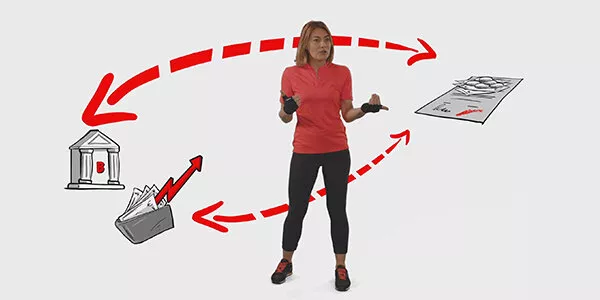

15 - What is a primary dealer bank?

Each month, a “primary dealer” helps countries renew their debts as they reach maturity. To do this, the Ministry of...

Each month, a “primary dealer” helps countries renew their debts as they reach maturity. To do this, the Ministry of...

Banktionary

Each month, a “primary dealer” helps countries renew their debts as they reach maturity. To do this, the Ministry of Finance calls on primary dealer banks whose mission is to find investors interested in buying these debts.

15 - What is a primary dealer bank?28

Feb

2020

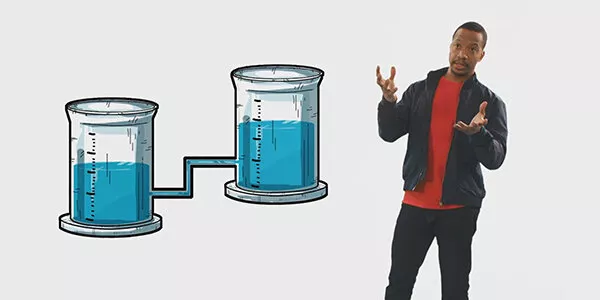

14 - What is collateral management?

Collateral management is a technique the bank uses to quickly identify what can be committed as collateral so that a...

Collateral management is a technique the bank uses to quickly identify what can be committed as collateral so that a...

Banktionary

Collateral management is a technique the bank uses to quickly identify what can be committed as collateral so that a transaction can be performed. When a company needs a lot of cash, to pay a supplier for instance, the bank will ask the business to commit part of its equity portfolio as collateral to secure the loan. Thanks to its expertise, the bank can...

14 - What is collateral management?28

Feb

2020

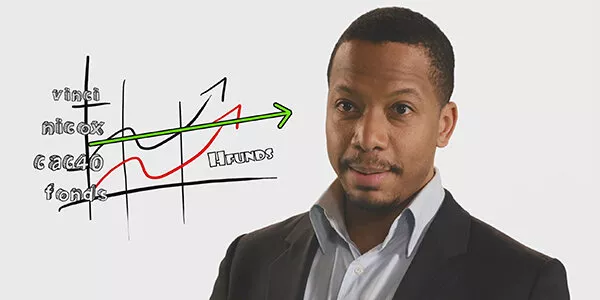

13 - What is a hedge fund?

A hedge fund is defined as more flexible than most common funds, which are usually benchmarked to an index like the...

A hedge fund is defined as more flexible than most common funds, which are usually benchmarked to an index like the...

Banktionary

A hedge fund is defined as more flexible than most common funds, which are usually benchmarked to an index like the CAC40 and try to outperform it. A hedge fund aims to achieve a stable performance of 10% every year by investing in currencies, bonds and other assets to avoid a loss.

13 - What is a hedge fund?28

Feb

2020

12 - How are banks involved in M&A transactions?

M&A stands for Mergers and Acquisitions. It defines the buyout or the fusion of two companies whose activities are...

M&A stands for Mergers and Acquisitions. It defines the buyout or the fusion of two companies whose activities are...

Banktionary

M&A stands for Mergers and Acquisitions. It defines the buyout or the fusion of two companies whose activities are similar. In this case, the bank has a crucial advisory role.

12 - How are banks involved in M&A transactions?28

Feb

2020

11 - What is a broker?

An equity broker works with a team of research analysts who constantly analyze the financial health of listed companies....

An equity broker works with a team of research analysts who constantly analyze the financial health of listed companies....

Banktionary

An equity broker works with a team of research analysts who constantly analyze the financial health of listed companies. Clients can base their orders on their financial analysis as sent by their broker. Their broker can also help them with their orders and the terms of execution.

11 - What is a broker?28

Feb

2020

10 - What are mutual funds?

Mutual funds are investment vehicles and a way of pooling investments for people who want to invest in the same kind of...

Mutual funds are investment vehicles and a way of pooling investments for people who want to invest in the same kind of...

Banktionary

Mutual funds are investment vehicles and a way of pooling investments for people who want to invest in the same kind of product. This fund is managed by a professional fund manager and their team in an asset management company.

10 - What are mutual funds?28

Feb

2020

9 - What is a clearing house?

Clearing defines how banks and financial institutions guarantee the payment and delivery of securities between two...

Clearing defines how banks and financial institutions guarantee the payment and delivery of securities between two...

Banktionary

Clearing defines how banks and financial institutions guarantee the payment and delivery of securities between two parties to a transaction. When one buys financial products like shares, the order they placed is fixed and final. The clearing house will then handle or unwind the transaction.

9 - What is a clearing house?28

Feb

2020

8 - What is private equity?

Capital development means that, through venture capital, a company can get a bank or investment fund to buy into its...

Capital development means that, through venture capital, a company can get a bank or investment fund to buy into its...

Banktionary

Capital development means that, through venture capital, a company can get a bank or investment fund to buy into its capital and participate in its growth. It gives the company financial security and an outside yet unobtrusive opinion on its decisions.

8 - What is private equity?28

Feb

2020

7 - What is a PPP?

A public-private partnership (PPP) is a contract by which the public sector enters into a business relationship with a...

A public-private partnership (PPP) is a contract by which the public sector enters into a business relationship with a...

Banktionary

A public-private partnership (PPP) is a contract by which the public sector enters into a business relationship with a private sector to build, finance, maintain, oversee and run a project.

7 - What is a PPP?28

Feb

2020

6 - What are bonds?

Bonds are a security that represents a part of a debt, unlike shares that represent a part of a company. It is issued in...

Bonds are a security that represents a part of a debt, unlike shares that represent a part of a company. It is issued in...

Banktionary

Bonds are a security that represents a part of a debt, unlike shares that represent a part of a company. It is issued in a given currency, for a defined period of time and gives right to the payment of a fixed or variable interest. At the end of this period, the initial capital is repaid.

6 - What are bonds?28

Feb

2020

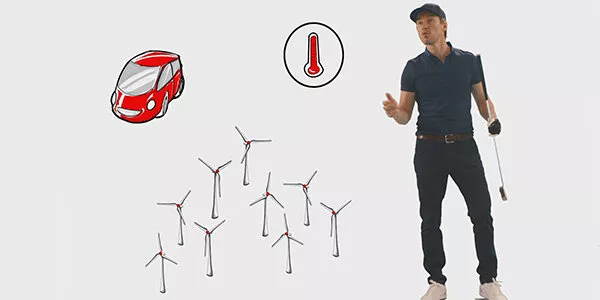

5 - What are green bonds?

A green bond is a loan for which the money that is raised goes towards financing green projects which have a positive...

A green bond is a loan for which the money that is raised goes towards financing green projects which have a positive...

Banktionary

A green bond is a loan for which the money that is raised goes towards financing green projects which have a positive impact on society. For instance: building a wind farm or financing research and eco-friendly engines, thermal insulation, renewable energy, etc.

5 - What are green bonds?28

Feb

2020

4 - What is an IPO?

An Initial Public Offering (IPO) or takeover bid occurs when a company offers to buy out all the shareholders of another...

An Initial Public Offering (IPO) or takeover bid occurs when a company offers to buy out all the shareholders of another...

Banktionary

An Initial Public Offering (IPO) or takeover bid occurs when a company offers to buy out all the shareholders of another entity. Takeover bids can be solicited (friendly) or not (hostile). To do so, banks accompany their clients by studying the project and its feasibility, and by facilitating the IPO. Such an operation can last for months.

4 - What is an IPO?28

Feb

2020

3 - What is structure finance?

When a company needs money to develop a project, it can use structured finance. This customized loan is broken down into...

When a company needs money to develop a project, it can use structured finance. This customized loan is broken down into...

Banktionary

When a company needs money to develop a project, it can use structured finance. This customized loan is broken down into levels of guarantee so that lenders in the upper level of the structure earn low interest rates and lenders at the bottom of the structure earn higher interest rates. The lower lenders are in the structure, the less guarantee they have of...

3 - What is structure finance?28

Feb

2020

2 - What is syndication?

Syndication is the process by which banks and investors join to make a loan to a company (creating a syndicate of...

Syndication is the process by which banks and investors join to make a loan to a company (creating a syndicate of...

Banktionary

Syndication is the process by which banks and investors join to make a loan to a company (creating a syndicate of banks).

With their client, the banks define the characteristics of the loan and work on key points to enhance the project.

2 - What is syndication?28

Feb

2020

1 - What are derivatives?

Derivatives allow anyone to buy a good or service that will be provided at a later date at a fixed price – despite, for...

Derivatives allow anyone to buy a good or service that will be provided at a later date at a fixed price – despite, for...

Banktionary

Derivatives allow anyone to buy a good or service that will be provided at a later date at a fixed price – despite, for example, changes in the price of raw materials or currencies (which are called "underlying assets").

1 - What are derivatives?19

May

2015

Executing and clearing a financial transaction

Executing and clearing a financial transaction

Executing and clearing a financial transaction

Supporting the economy

Executing and clearing a financial transaction

Executing and clearing a financial transaction19

May

2015

How trading rooms play a central role in financing the economy?

How trading rooms play a central role in financing the economy?

How trading rooms play a central role in financing the economy?

Supporting the economy

How trading rooms play a central role in financing the economy?

How trading rooms play a central role in financing the economy?19

May

2015

Understanding the role of a corporate & investment bank

Role of a corporate & investment bank

Role of a corporate & investment bank

Supporting the economy

Role of a corporate & investment bank

Understanding the role of a corporate & investment bank