Leveraged Finance

Societe Generale's Leveraged Finance offering provides you with innovative and integrated financing solutions to meet your objectives in multiple areas of expertise. It consists of originating, structuring, and executing Leveraged Buy-Out (LBO) financing transactions supported by private equity funds. It covers both leveraged loans and high-yield bonds.

We provide our financial sponsors and corporate clients with innovative and integrated financing solutions to achieve their objectives, across multiple areas of expertise.

- Leveraged Buy-Outs (LBOs)

Supporting our financial sponsor clients, we structure and deliver LBO financing, in all sectors. We are present in the main European markets (Paris, London, Frankfurt, Madrid) and in the US.

- Corporate Leveraged Finance

Our expertise focuses on corporate leveraged loan and high yield offering and targets leveraged companies where there is visibility for short to medium-term high yield issuance.

- High Yield capital markets

Working together with Debt Capital Markets teams, we propose an advisory approach to upscale our high yield offering, with high yield platforms based in Paris, London and New York, covering both European and US markets.

Related solutions

Our Debt Capital Markets platform provides holistic debt advisory services, leveraging the profound expertise of an...

Societe Generale is a leading player for all Mergers and Acquisitions (M&A) transactions (acquisitions, disposals,...

Credit rating is fundamental to an organisation’s financial strength. Societe Generale has been one of the first banks...

Read about our clients' success stories

Northern Virginia’s “Data Center Alley” remains the leading hub for hyperscale data centers in the US, but rising AI...

By securing EUR 671 million in financing, Verdalia Bioenergy can continue its development through the construction and...

Societe Generale supported Zetra, a pioneering French player in electric heavy mobility, in financing a portfolio of...

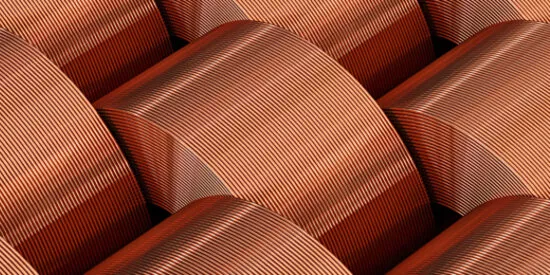

Arizona’s copper reserves, formed millions of years ago, are critical to America’s energy transition and tech growth....