Equator principles reporting

The EP Association introduced new reporting obligations in order to improve transparency on transactions financed by members of the association.

EP Reporting Under EPIII

In 2015, the EP Association introduced new reporting obligations in order to improve transparency on transactions financed by members of the association. As a consequence, each EPFI shall report, at least annually, on transactions that were subject to the Equator Principles and have reached Financial Close and on its Equator Principles implementation processes and experience.

Societe Generale 2018 EP Data

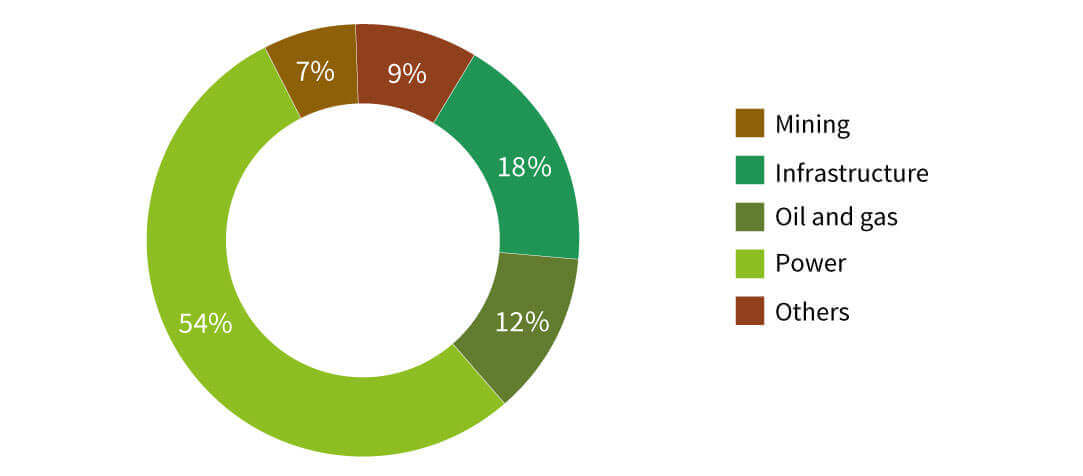

In 2018, 56 transactions, namely 42 project finance transactions, 4 project-related corporate loans, 1 bridge loan and 9 project finance advisory mandates falling within the scope of the Equator Principles, were signed. Among these transactions, 53% are related to renewable power projects (an increase of 13pt as compared to 2017).

These data are certified by our external auditor (EY).

The Societe Generale’s 2018 EP Reporting Table (see after) shows the detailed distribution of the financial products and services signed in 2018 which fall in the EP scope. The breakdown follows the guidelines developed by the EP Association.

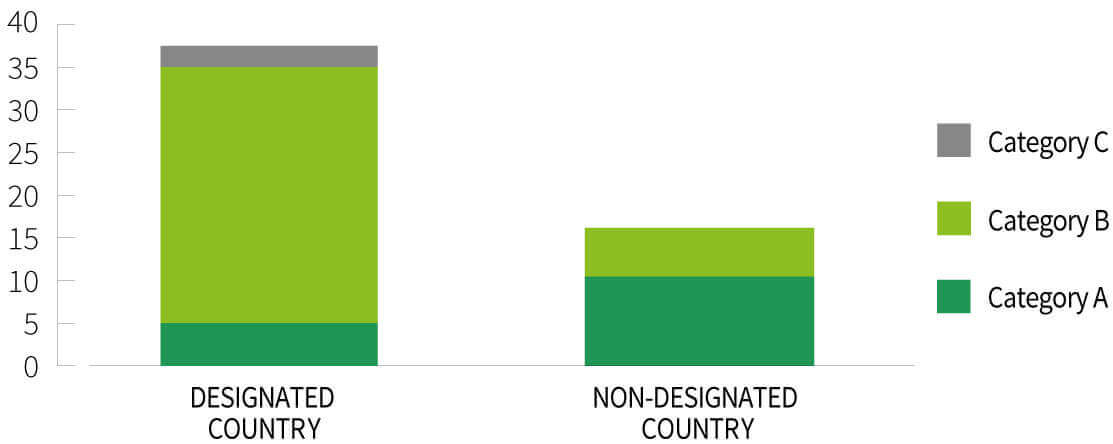

In 2018, 29% of the transactions signed were category A, 66% category B and 5% category C. Most of the underlying projects are located in Europe, as well as in the Asia Pacific and Americas regions. For each transaction, the E&S Due Diligence process conducted by Societe Generale was commensurate with the nature, scale and stage of the Project, and with the level of environmental and social risks and impacts. The internal E&S Due Diligence was supported by an Independent E&S Review for all the Project Finance loans categorised A or B.

Moreover, for the 15 category A and B transactions associated with Projects located in non-designated countries, the application of the EPs implies a development of the underlying Projects in alignment with the IFC Performance Standards and World Bank EHS Guidelines, in addition to compliance with local E&S laws, regulations and standards.

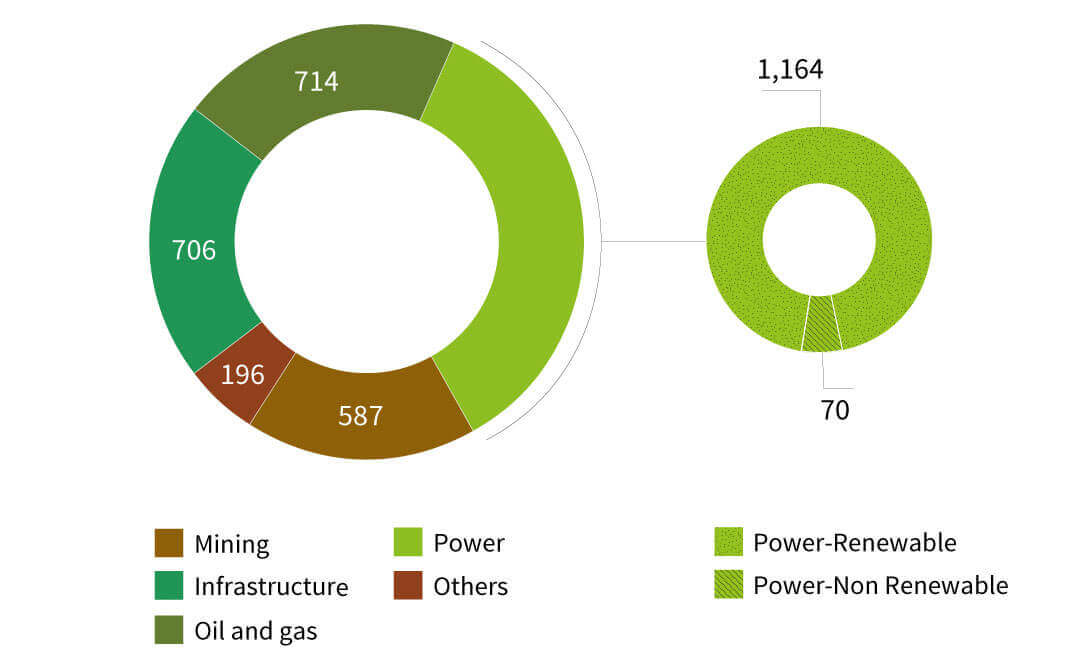

For the 47 financing transactions (i.e. Project Finance transactions, bridge loans and Project-Related Corporate Loans) signed in 2018, Societe Generale’s allocation represents a total of EUR 3.4 billion, of which EUR 1,164 million were allocated to renewable power Projects, i.e. 94% of total Power Bank EP commitments this year (an increase of 16pt as compared to 2017).

Among these, Societe Generale successfully backed the Nachtigal hydroelectric power station project[3] in Cameroon, the largest hydropower project ever built in Africa through project finance. The 420-MW plant will supply almost a third of Cameroon’s electricity, improving the reliability of the country’s power system, and its electricity will be sold at a competitive tariff that will benefit consumers. Accompanying the five years construction of the dam, there will be a regional socio-economic development program, which will start after consultations with local stakeholders, designed to identify their needs, including the creation of 1,500 direct jobs, most of them for local people.

[3] More information available at: https://wholesale.banking.societegenerale.com/en/about/news-press-room/news-details/news/advancing-cameroones-low-carbon-development-through-hydropower/

2018 report

- Equator principles

- Framework - Societe Generale's commitments

- Societe Generale’s decision making process

- Equator principles reporting

- Contribution to the Equator principles development

- Societe Generale's 2018 EP reporting table

- Landmark transactions

- Project name reporting for project finance

- Download PDF report

Equator Principles Categories

Category A – Projects with potential significant adverse environmental and social risks and/or impacts that are diverse, irreversible or unprecedented;

Category B – Projects with potential limited adverse environmental and social risks and/or impacts that are few in number, generally site-specific, largely reversible and readily addressed through mitigation measures;

Category C – Projects with minimal or no adverse environmental and social risks and/or impacts

EP transactions signed by country designation and category in 2018 (number of transactions)

EP transactions signed by sector in 2018 (number of transactions)

EP transactions signed by sector in 2018 (Amounts of Societe Generale commitments, M Eur)