Debt Capital Markets

Our Debt Capital Markets platform provides holistic debt advisory services, leveraging the profound expertise of an extensive, fully integrated setup.

From rating advisory, structuring, hedging, market and sector expertise to global distribution power, we deliver best suited capital markets solutions for our clients worldwide.

Thanks to a strong track record of consistently delivering successful transactions and helping clients navigate even the most challenging conditions, we have turned into a universally strong capital markets advisor to clients across all regions and segments. Our Debt Capital Markets platform is an integral component of Societe Generale’s powerful Investment Banking platform and supports the delivery of our clients’ strategic goals.

We offer DCM issuance activities for corporates, financial institutions, sovereign entities, and other public sector organisations. We handle bond issuances, hybrid debt, ESG bond structuring, financial engineering, as well as asset and liability management advisory.

Related solutions

Societe Generale's Leveraged Finance offering provides you with innovative and integrated financing solutions to meet...

Credit rating is fundamental to an organisation’s financial strength. Societe Generale has been one of the first banks...

Read about our clients' success stories

Northern Virginia’s “Data Center Alley” remains the leading hub for hyperscale data centers in the US, but rising AI...

By securing EUR 671 million in financing, Verdalia Bioenergy can continue its development through the construction and...

Societe Generale supported Zetra, a pioneering French player in electric heavy mobility, in financing a portfolio of...

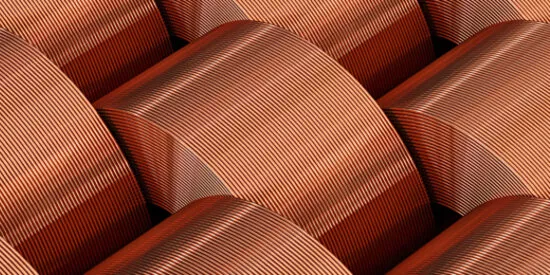

Arizona’s copper reserves, formed millions of years ago, are critical to America’s energy transition and tech growth....