Corporates

As a bank founded by entrepreneurs for entrepreneurs, we know what it takes to grow and develop businesses.

Enhance your access to finance through bespoke global solutions that bring together expert advice and powerful distribution. Our services cover M&A, capital structure advisory, and asset & liability management. They are combined with high-quality debt and equity capital raising, optimised financing, and risk management specialising in foreign exchange and rates derivatives notably.

Select the Solutions & Services designed for you

Select

Our clients' successes

Data Center Alley: Meeting Surging Demand for Computational Power in the US

Northern Virginia’s “Data Center Alley” remains the leading hub for hyperscale data centers in the US, but rising AI...

Northern Virginia’s “Data Center Alley” remains the leading hub for hyperscale data centers in the US, but rising AI...

Clients' successes

Northern Virginia’s “Data Center Alley” remains the leading hub for hyperscale data centers in the US, but rising AI driven demand is expanding development into neighboring regions like Maryland. Societe Generale is reinforcing its leadership in financing US hyperscale infrastructure, highlighted by major deals including recently the USD 925m Rowan Digital...

Data Center Alley: Meeting Surging Demand for Computational Power in the US

Supporting biomethane production in Spain and Italy

By securing EUR 671 million in financing, Verdalia Bioenergy can continue its development through the construction and...

By securing EUR 671 million in financing, Verdalia Bioenergy can continue its development through the construction and...

Clients' successes

By securing EUR 671 million in financing, Verdalia Bioenergy can continue its development through the construction and acquisition of several biomethane production sites in Spain and Italy.

Supporting biomethane production in Spain and Italy

Accelerating heavy transport electrification

Societe Generale supported Zetra, a pioneering French player in electric heavy mobility, in financing a portfolio of...

Societe Generale supported Zetra, a pioneering French player in electric heavy mobility, in financing a portfolio of...

Clients' successes

Societe Generale supported Zetra, a pioneering French player in electric heavy mobility, in financing a portfolio of charging points dedicated to trucks. The Bank acted as Structuring Bank, Mandated Lead Arranger, Sole Lender, Hedge Provider, Facility Agent, and Account Bank, in Europe’s first non-recourse project financing dedicated to electric truck charging...

Accelerating heavy transport electrification

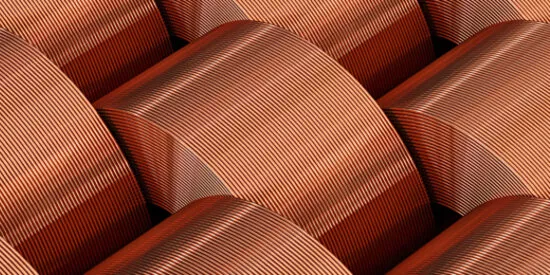

Financing the First Significant US Copper Mine in Two Decades

Arizona’s copper reserves, formed millions of years ago, are critical to America’s energy transition and tech growth....

Arizona’s copper reserves, formed millions of years ago, are critical to America’s energy transition and tech growth....

Clients' successes

Arizona’s copper reserves, formed millions of years ago, are critical to America’s energy transition and tech growth. With demand set to surge, Ivanhoe Electric’s Santa Cruz Copper Mine project aims to help secure US supply and strengthen competitiveness. The project financing is the first transaction in the Americas for Societe Generale under the Emerging...

Financing the First Significant US Copper Mine in Two Decades

More results

google link