Factoring and Receivables finance

Definition

Like the transfer of commercial paper, the transfer of receivables allows a company to obtain cash very quickly. This transfer takes place within the framework of a financial technique, called factoring.

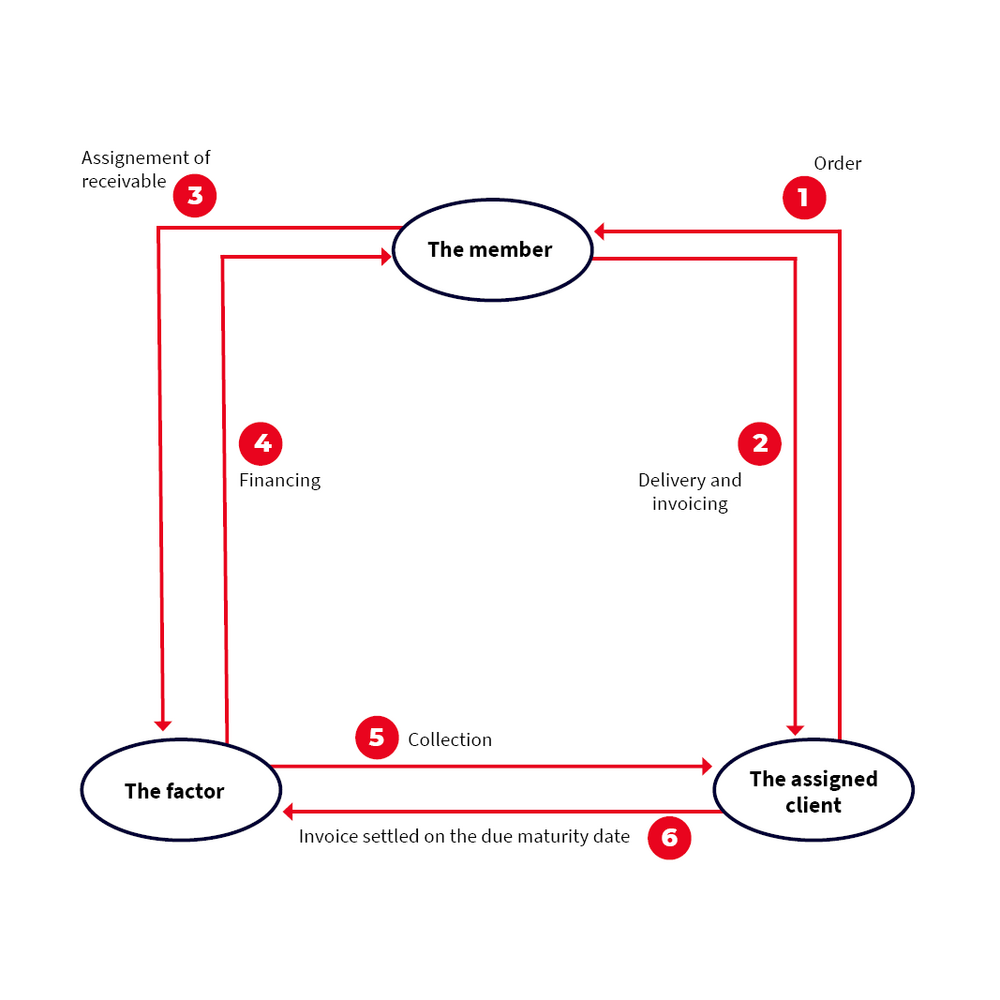

Procedure for the transfer of receivables in the context of factoring

The factoring is a financing technique allowing a company (the member) to transfer its receivables from a customer (the assigned customer) to a financial institution specialized in factoring (called the factor).

Even if it can be a punctual financing via the session of some receivables, it is rather a financing in time. Indeed the contracts can go up to 5 years. The factor must therefore decide:

- the type of receivables he is ready to buy (average amount, duration)

- the assigned customers on which it is willing to take a risk

The cost of factoring is composed of a factoring commission and a financing commission.

The financing commission corresponds globally to the interest rates since it is primarily a cash advance.

The factoring commission corresponds to the cost of collecting the receivables (cost of managing the file, reminders, losses, etc.)

Advantages for the member

1- The member is credited quickly (24 to 48 hours depending on the factor) and has a greater visibility on his cash flow and optimizes it.

2- This technique can also be used to meet specific cash flow needs

3- Factoring is useful to support a company in a growth phase.