China’s economic challenges are spooking global investors. Is the fear warranted?

Despite the deepening troubles in China’s property sector, a financial crisis that could spill over into global markets looks unlikely.

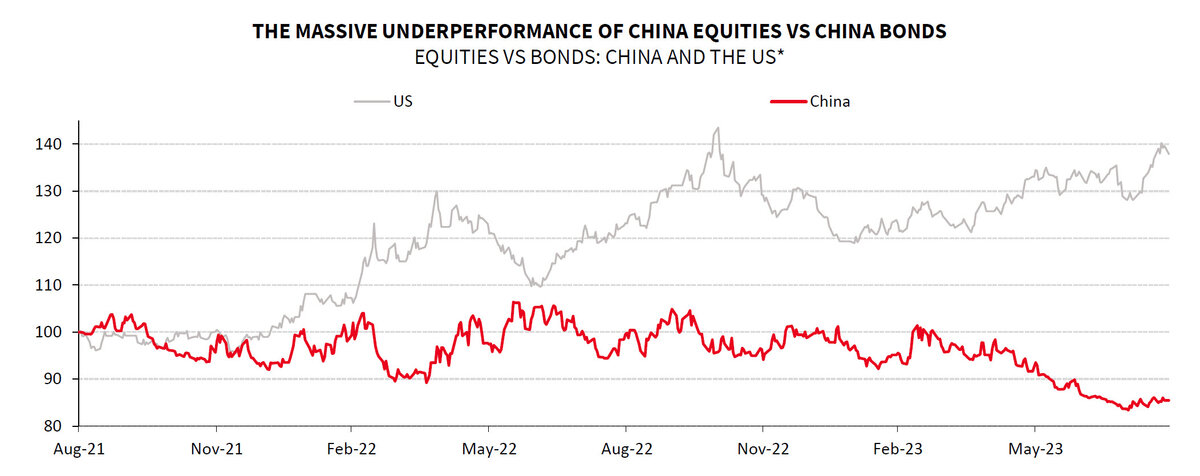

China has fallen out of favour for many global investors in recent months. After a brief rally at the beginning of the year, following the removal of pandemic controls, Chinese risk assets have fallen heavily.

Furthermore, the ongoing crisis in the country’s property sector has investors particularly worried. While the debt crisis in the property sector will continue to weigh on Chinese growth, Societe Generale analysts do not expect the troubles to spill over into other markets.

A slow-moving crisis

The biggest fear for investors is perhaps the health of China’s financial sector, given that the property sector accounts for about 20% of total commercial banking assets, as of the end of 2022.

While property defaults are soaring in the offshore bond market, domestic bank loans are in a stronger position. Even in an extreme scenario where 10% of developer loans become non-performing, the total amount of non-performing assets would not exceed the total profits of the banking system in 2022, according to Societe Generale’s calculations. In theory, therefore, the overall banking system can absorb these losses over the course of a few years without much recapitalisation.

Chinese authorities have also signalled a willingness to address a build-up in local government debt. Plans on the table include a debt swap, which would relieve fears of credit stress. The dominance of state-owned enterprises in the financial system allows policymakers to engineer a steady deleveraging and control the pace of asset price corrections.

China assets

This lasting drag on growth has implication for domestic and global assets.

The question for investors, however, is whether the worst of the economic pain is already priced in.

As growth expectations find a floor, investors can look for pockets of value. Consumer stocks tend to outperform industrial stocks in a deleveraging process, and internet platforms are attractively valued. China’s green transition is also an attractive long-term theme.

Fixed-income investments, meanwhile, can be expected to benefit from a prolonged deleveraging process, which is likely to require lower interest rates. This implies that Chinese Government bonds should continue to outperform domestic equities.

Slower growth and lower rates are also a drag on China’s currency. The renminbi is on track to depreciate to 7.60 to the US dollar, according to forecasts by Societe Generale.

Taking a view on the currency or rates, however, is complicated. The clear weakening trend slowed in August, and policy changes have given investors pause for thought. A funding squeeze in the offshore renminbi (CNH) market is a concern. In rates, the difference in yields between US Treasuries and Chinese Government bonds makes it hard for overseas investors to generate a return: any move higher in bond prices is likely to be cancelled out by currency weakness.

Global spillovers

What about the risks of contagion to international markets? Global investors have been diversifying their focus to other markets in Asia Pacific, and onshore Chinese investors have been looking to expand into overseas markets. Japan, South Korea, Taiwan and India have outperformed, and volumes have increased significantly.

These markets remain well-placed. Even though Korea and Taiwan are heavily exposed to slowing Chinese demand, the impact of a drop in China’s real GDP growth would likely be mitigated by rising semiconductor demand, driven by the growth of artificial intelligence. Other markets in Southeast Asia and India benefit from their own domestic dynamics. Cyclical industrial stocks, however, are most at risk of a further correction – especially those exposed to real estate construction.

The implications for the FX market may be more pronounced, as the importance of Chinese demand means several Asian currencies, such as the Thai baht, are correlated to the renminbi. The Indian rupee, in that context, stands out as the least exposed to weakness in the renminbi – thanks to India’s limited linkages with China’s economy.

Source: SG Cross Asset Research/Equity Strategy. *US: relative returns of the S&P500 vs an index of 7-10y US Treasury; China: relative returns of the CSI vs an index of 5-10y Chinese government bonds.

THE FIGURES RELATING TO PAST PERFORMANCES AND/OR SIMULATED PAST PERFORMANCES REFER OR RELATE TO PAST PERIODS AND ARE NOT A RELIABLE INDICATOR OF FUTURE RESULTS. THIS ALSO APPLIES TO HISTORICAL MARKET DATA.

Market access

As it is difficult to trade Chinese Government bonds, investors can look to more accessible proxies to position for an L-shaped recovery in China.

Korean Treasury bonds (KTBs) are one such alternative. The yield on the 10-year KTB has risen to around 4.38% from 3.30% six months ago1, and rate cuts are not yet priced in. KTBs are also a candidate for inclusion in major global bond indices, which would trigger additional inflows, and offer attractive returns versus US Treasuries after hedging.

Societe Generale’s full-service markets business provides different channels for investors to access the KTB market, including direct access to the onshore bond market and repo financing, as well as total return swaps and KTB bond forward pricing. Recently named Interest Rate Derivatives House of the Year in the Asia Risk Awards 20232, Societe Generale also provides access to Chinese onshore and offshore rates and fixed income opportunities.

For equity investors looking to diversify into markets such as Korea and Taiwan, Societe Generale offers both local currency and US dollar funding, and can assist with navigation of strict short-selling rules that remain in place in both markets. Societe Generale also provides simple and customisable access to more than 15 Asia Pacific equity markets under a single derivatives contract.

For more information on Societe Generale’s Global Markets research, please visit: https://insight-public.sgmarkets.com/

1. https://www.bok.or.kr/eng/bbs/E0000634/view.do?nttId=10079950&menuNo=400069

2. https://www.risk.net/awards/7957767/interest-rate-derivatives-house-of-the-year-societe-generale

IMPORTANT NOTICE: This website and its contents are for informational purposes only and is not a recommendation or an offer or solicitation for the purchase or sale of any security or financial instrument. SG Research is for institutional and professional clients only. Visitors to this site should not take any investment decision based on the summary material provided here, which should be read in the context of the underlying research report made available to subscribers.

Unless otherwise stated, any views or opinions expressed in the presentation are solely those of the presenter(s) and may differ from the views and opinions of others at, or other departments or divisions of, Societe Generale (“SG”) and its affiliates. No part of the presenter(s) compensation was, is or will be related, directly or indirectly to the specific views expressed herein. This material is provided for information purposes only and is not intended as a recommendation or an offer or solicitation for the purchase or sale of any security or financial instrument. The information contained herein has been obtained from, and is based upon, sources believed to be reliable, but SG and its affiliates make no representation as to its accuracy and completeness. The views and opinions contained herein are those of the author of this material as of the date of this material and are subject to change without notice. Neither the presenter(s) nor SG has any obligation to update, modify or otherwise notify the recipient in the event any information contained herein, including any opinion or view, changes or becomes inaccurate. To the maximum extent possible at law, SG does not accept any liability whatsoever arising from the use of the material or information contained herein.

This presentation should not be construed as investment research as it has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Therefore, even if it contains a research recommendation, it should be treated as a marketing communication. This publication is not subject to any prohibition on dealing ahead of the dissemination of investment research. Notwithstanding the preceding sentence SG is required to have policies in place to manage the conflicts which may arise in the production of its research, including preventing dealing ahead of investment research.