Equity Capital Markets

Societe Generale offers its clients a comprehensive platform of services dedicated to Equity Capital Markets (ECM) transactions, including initial public offerings (IPOs), capital increases, equity-linked products as well as strategic equity solutions.

Societe Generale and Bernstein, a strategic partnership to deliver best-in-class ECM solutions globally

Through this partnership, we offer our clients an extended range of solutions on Equity Capital Markets. It covers IPOs, capital increases, equity-linked products as well as strategic equity, with Bernstein acting as the global ECM distribution platform.

Our ECM offering is an integral component of Societe Generale's powerful Investment Banking platform and supports the delivery of our clients’ strategic objectives. With an integrated structure, we deliver the value of the entire equity chain, drawings on a world-class equity derivatives, cash and research offering to meet the needs of all issuer clients in the North American, European and Asia Pacific equity markets.

Our global presence provides us with unmatched capabilities in cash equities and equity research. This allows our clients to access an ever-expanding network of investors and get an ever-broader access to the equity capital markets globally, supporting them in growing their businesses.

Access to the dedicated website to learn more about Bernstein

Related solutions

Credit rating is fundamental to an organisation’s financial strength. Societe Generale has been one of the first banks...

Read about our clients' success stories

Northern Virginia’s “Data Center Alley” remains the leading hub for hyperscale data centers in the US, but rising AI...

By securing EUR 671 million in financing, Verdalia Bioenergy can continue its development through the construction and...

Societe Generale supported Zetra, a pioneering French player in electric heavy mobility, in financing a portfolio of...

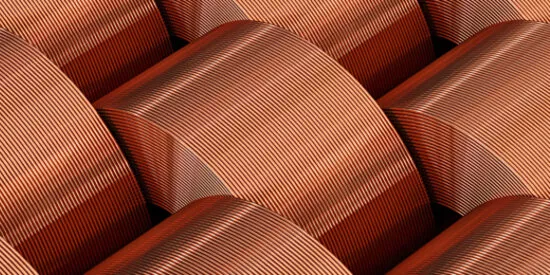

Arizona’s copper reserves, formed millions of years ago, are critical to America’s energy transition and tech growth....