Investment Banking

The Societe Generale Investment Banking offering covers a full range of products and services. We provide our clients with high value-added advice, sector expertise, and excellence in the execution of local and cross-border transactions.

Tailored Advice and Solutions

Relationship | Strategic Advisory | Financing

We support our clients across all their Investment Banking needs, whether it involves strategic advisory, Mergers and Acquisitions, Equity and Debt Capital Markets, or acquisition financing with or without leverage.

Our teams rely on our sector experts, who engage in high-level dialogue with our clients, providing them with strategic sector-specific insights.

We offer tailored advice and solutions in strategic advisory, mergers and acquisitions, capital markets, structured equity and cross-assets transactions. We are a leading European bank with a global reach, enabling us to support your needs worldwide. Client relationships are our key driver — we are committed to your success and measure our performance by the value we create for you.

Investment Banking solutions

Our Debt Capital Markets platform provides holistic debt advisory services, leveraging the profound expertise of an...

Societe Generale offers its clients a comprehensive platform of services dedicated to Equity Capital Markets (ECM)...

Societe Generale's Leveraged Finance offering provides you with innovative and integrated financing solutions to meet...

Societe Generale is a leading player for all Mergers and Acquisitions (M&A) transactions (acquisitions, disposals,...

Credit rating is fundamental to an organisation’s financial strength. Societe Generale has been one of the first banks...

Our Strategic & Acquisition Finance teams are active through a network of professionals based in Paris, London, Madrid,...

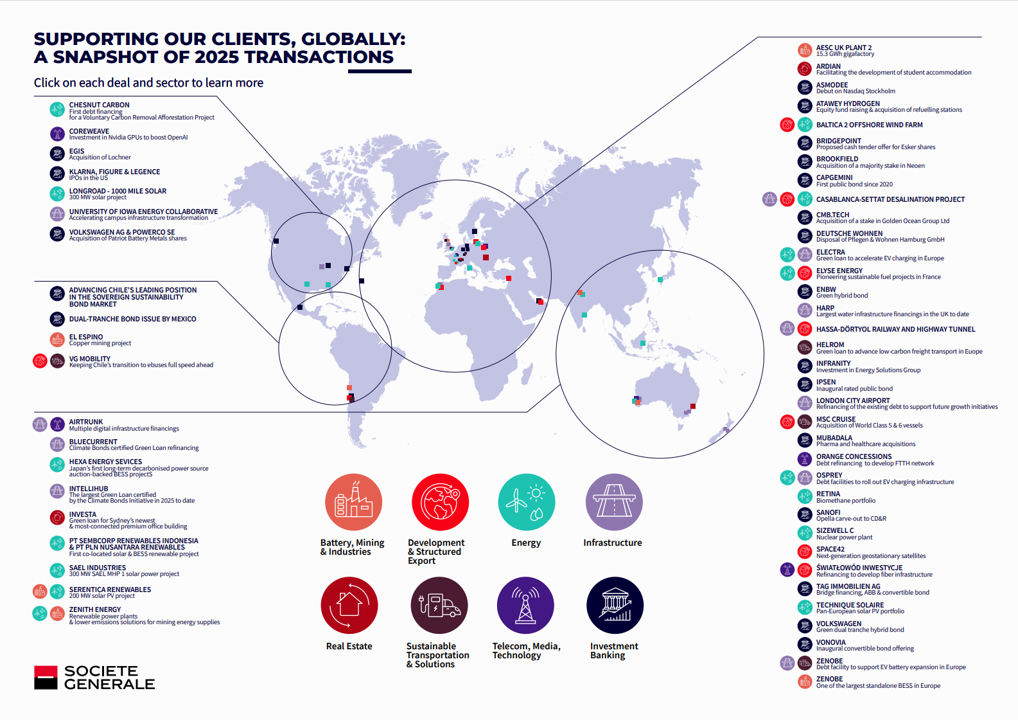

Read about our clients' success stories

Northern Virginia’s “Data Center Alley” remains the leading hub for hyperscale data centers in the US, but rising AI...

By securing EUR 671 million in financing, Verdalia Bioenergy can continue its development through the construction and...

Societe Generale supported Zetra, a pioneering French player in electric heavy mobility, in financing a portfolio of...

Arizona’s copper reserves, formed millions of years ago, are critical to America’s energy transition and tech growth....