Export Finance

Financing solutions, risk coverage and advisory services related to import or export contracts.

We deliver financing solutions, risk coverage and advisory services related to the origination, structuring and execution of the financing of your projects or assets. Our expertise focuses on import or export contracts whose underlying assets are capital goods, equipment and/or services to companies and financial institutions around the world.

Our organisation is founded on privileged relationships with exporters and borrowers, as well as a number of countries through various export credit agencies or worldwide public agencies supporting exports. Together we arrange and finance export operations for you.

We provide you with long-term financing, and foreign exchange financing in US dollars, euros, yen, Swiss francs, or even in a local currency if accepted by the export credit agency.

Tailored solutions in dedicated sectors

Related solutions:

From cash to derivatives, we offer bespoke fixed income and foreign exchange solutions.

As your long-term business partner, we offer global and local payments and collections, liquidity management and...

With an international trade network covering 37 countries, we support your development projects by securing and...

Our clients' successes

Northern Virginia’s “Data Center Alley” remains the leading hub for hyperscale data centers in the US, but rising AI...

By securing EUR 671 million in financing, Verdalia Bioenergy can continue its development through the construction and...

Societe Generale supported Zetra, a pioneering French player in electric heavy mobility, in financing a portfolio of...

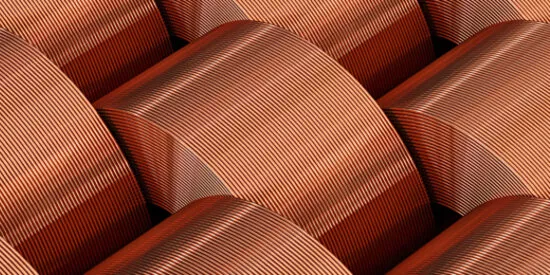

Arizona’s copper reserves, formed millions of years ago, are critical to America’s energy transition and tech growth....