Equator principles reporting

EP Reporting Under EPIII

In 2015, the EP Association introduced new reporting obligations in order to improve transparency on transactions financed by members of the association. As a consequence, each EPFI shall report, at least annually, on transactions that were subject to the Equator Principles and have reached Financial Close and on its Equator Principles implementation processes and experience.

Societe Generale 2017 EP Data

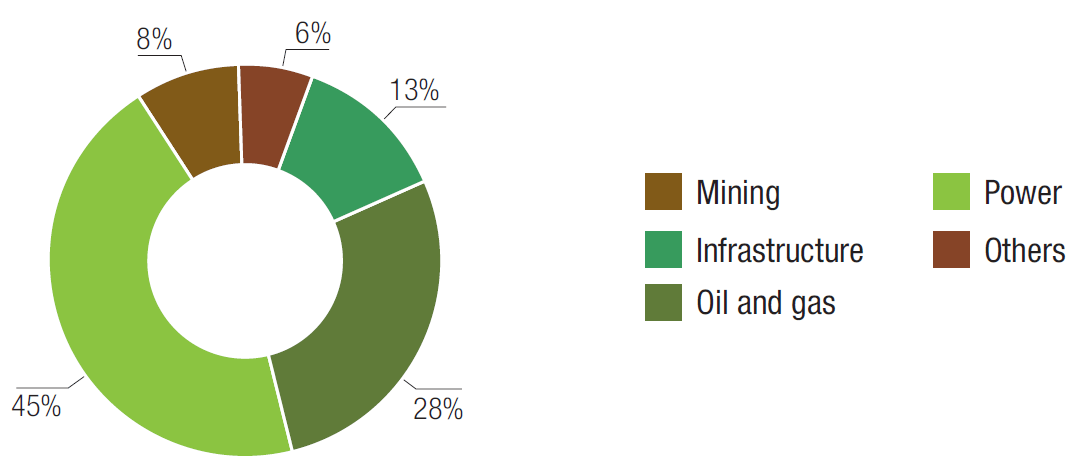

In 2017, 47 transactions, namely 27 project finance

transactions, 5 project-related corporate loans and 15 project

finance advisory mandates falling within the scope of the

Equator Principles, were signed. Among these transactions,

40% are related to renewable power projects (an increase of

5pt as compared to 2016).

These data are certified by our external auditor (EY).

The Societe Generale’s 2017 EP Reporting Table (see after)

shows the detailed distribution of the financial products

and services signed in 2017 which fall in the EP scope.

The breakdown follows the guidelines developed by the EP

Association.

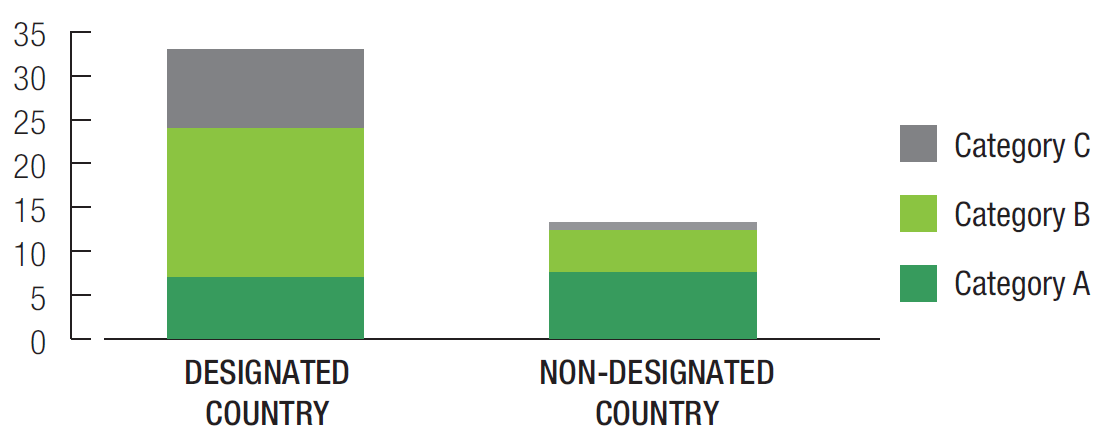

In 2017, 32% of the transactions signed were category A, 47%

category B, 21% category C. Most of the underlying projects

are located in Europe and in the Asia Pacific regions. For each

transaction, the E&S Due Diligence process conducted by

Societe Generale was commensurate with the nature, scale

and stage of the Project, and with the level of environmental

and social risks and impacts. The internal E&S Due Diligence

was supported by an Independent E&S Review for all the

financed Projects categorised A or B.

Moreover, for the 9 category A and B transactions associated

with Projects located in non-designated countries, the

application of the EPs implies a development of the underlying

Projects in alignment with the IFC Performance Standards and

World Bank EHS Guidelines, in addition to compliance with

local E&S laws, regulations and standards.

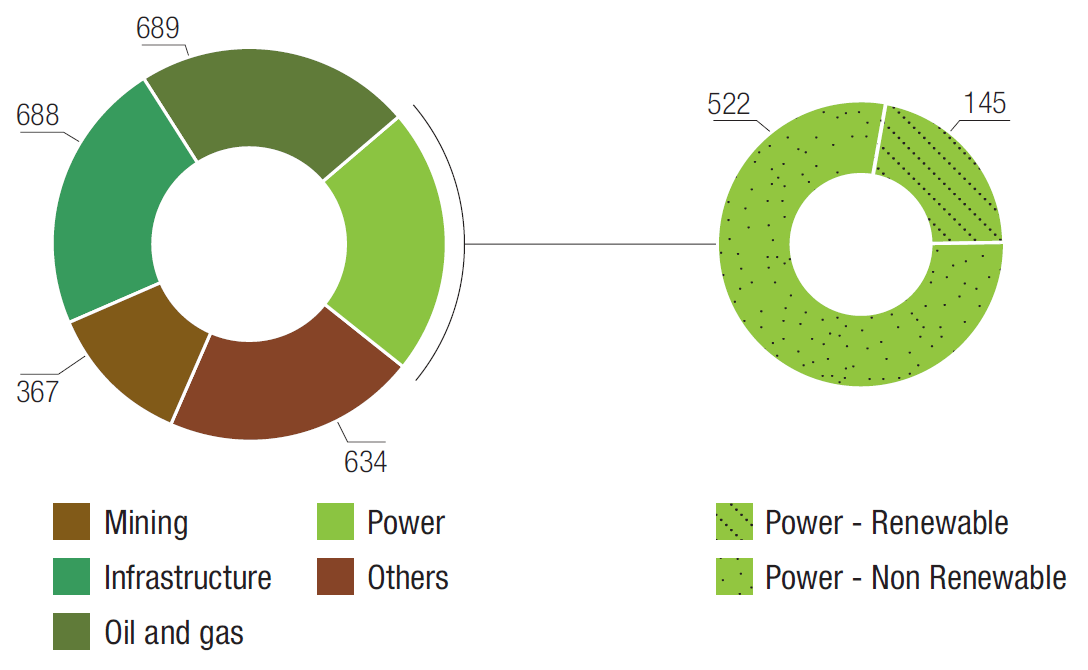

For the 32 financing transactions (i.e. Project Finance

transactions and Project-Related Corporate Loans) signed in

2017, Societe Generale’s allocation represents a total of EUR

3 billion, of which EUR 522 million were allocated to renewable

power Projects, i.e. 78% of total Power Bank EP commitments

this year (an increase of 21pt as compared to 2016).

Among these, Societe Generale successfully backed the 250

MW Ras Ghareb wind farm project(1), the largest wind farm

to be launched in the country to date, sitting at the core of

Egypt’s strategy to diversify away from fossil fuels, increase

consumer access to affordable electricity and ensure a longterm,

independent energy supply.

2017 report

- Equator principles

- Framework - Societe Generale's commitments

- Societe Generale’s decision making process

- Equator principles reporting

- Contribution to the Equator principles development

- Societe Generale's 2017 EP reporting table

- Project name reporting for project finance

- Table of the 2017 EP project finance transactions

- Download PDF report

Equator Principles Categories

Category A – Projects with potential significant adverse environmental and social risks and/or impacts that are diverse, irreversible or unprecedented;

Category B – Projects with potential limited adverse environmental and social risks and/or impacts that are few in number, generally site-specific, largely reversible and readily addressed through mitigation measures;

Category C – Projects with minimal or no adverse environmental and social risks and/or impacts

EP transactions signed by country designation and category in 2017 (number of transactions)

EP transactions signed by sector in 2017 (number of transactions)

EP transactions signed by sector in 2017 (Amounts of Societe Generale commitments, M Eur(1))