Financing of a leading Western European diagnostic imaging player developing technologies critical to modern healthcare

In a context of profound change, technological innovation and its progress are crucial to modern healthcare. Founded by InfraVia, Quartz Healthcare is a young European medical network operating in the fields of diagnostic imaging, radiotherapy and nuclear medicine, with strong international growth ambitions.

High investments needed in healthcare equipment and technology

Facing major evolutions such as ageing populations with certain healthcare needs, the higher prevalence of chronic diseases, the increasing focus on prevention and awareness, the need for faster and more accurate diagnosis, the shift to outpatient care or the constant pressure on public systems, the healthcare sector requires high levels of investment in equipment and technology.

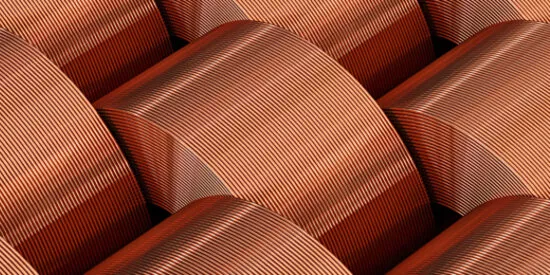

Among the innovations in this area, medical imaging is more and more combined with other medical examinations to diagnose diseases. It is also becoming key to medical research to understand how diseases develop and function or to develop new remedies. One branch of medical imaging, diagnostic imaging (DI), aims to produce visual representations of the inside of the human body and is used to identify many non-transmissible or chronic diseases, in particular cardiovascular diseases, cancer, chronic respiratory diseases or diabetes and neurological conditions linked to older age. DI relies heavily on technologies such as radiography, echography, fluoroscopy or nuclear medicine.

Quartz Healthcare, a young DI company in development

Quartz Healthcare, a leading Western European DI player, is a DI network providing diagnostics and therapies at the highest medical and technical level. It serves more than 660,000 patients treated in radiology, nuclear medicine and radiotherapy. Founded in Germany in 2022 by CEO Ludovic Robert and a group of senior doctors in partnership with InfraVia, Quartz aims to develop through acquisitions, new sites and new hospital co-operations a network of DI clinics. Quartz’s mission is to invest in expanding DI asset base (MRI, CT, Pet Scan) and technology to give patients access to the best clinical practices and offer doctors the latest technological innovations. Since its creation, its network has successfully grown and is now the 4th largest network in Germany, present in 27 locations in three clusters (Bavaria, North Rhine and Westphalia) and has ambitions to expand further both in Germany and in other Western European countries such as France.

The future of medical imaging lies primarily in the ability to respond to several axes of improvement, such as enhancing image quality, getting more precise information about how cells function, improving the ability to bring together complementary data, or improving the analysis of images and information. The increasing use of advanced DI modalities is a major driver of investment needs.

Societe Generale acted as Original Lender, Sole Hedging Bank, Facility Agent, Security Agent and Account Bank of a €122 million financing package for Quartz Healthcare. This debt package combining drawn and undrawn tranches will be used to help meeting these investment needs, funding equipment and technology capital expenditure as well as external growth. Providing Quartz with its first platform and at-scale financing demonstrates the Bank's support for the development of medical imaging and the advancement of modern healthcare. This transaction reinforces Societe Generale's position as a major player in the healthcare sector recognised for its strong in-house expertise, structuring capabilities and commitment to positive impact finance.