A new spring for Asia’s green transition

By Amy Zhang, ESG Solutions and Product Strategist for Asia Pacific at Societe Generale

Societe Generale Global Markets experts share their views on the drivers and strategies shaping the green transition in Asia – and what it all means for investors.

February 2024 marked the first time average global temperatures had breached the benchmark of 1.5°C above pre-industrial levels, a critical threshold in the 2015 Paris Agreement, over a 12-month period .

Asia Pacific, accounting for over half of global CO2 emissions and home to three out of the top five CO2 emitters in the world, is at the centre of the efforts to curb carbon emissions.

Home to around 60% of world population with an average life expectancy of 74 , Asia’s energy demand is projected to increase by 2.5 times by 2050, on the back of economic development, population growth, and urbanisation . The green transition represents both tremendous challenges and vast opportunities to this region.

Different paths to net zero

Wei Yao, Chief Economist and Head of Research, Asia Pacific, points out that governments typically promote decarbonisation by pushing up the cost of carbon to make emissions more expensive, and/or lowering the cost of lower-carbon alternatives to spur demand. Europe tends to be more focused on the former, while across Asia, it is a mixed bag. China is markedly tilted towards the latter.

“It’s a supply-side climate change policy. The approach is basically: we build, then there will be demand,” she says.

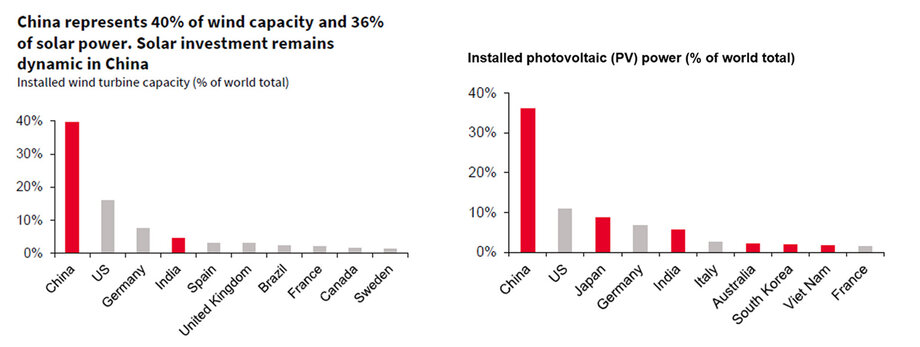

China’s energy transition policies have been effective in pulling down the cost of green technologies, such as solar. China dominates renewable supply chains globally and is well on track to meet its goal of having 1,200 gigawatts (GW) of installed wind and solar capacity by 2025, five years ahead of target, according to Societe Generale research.

Source: SG Cross Asset Research/Equity Strategy

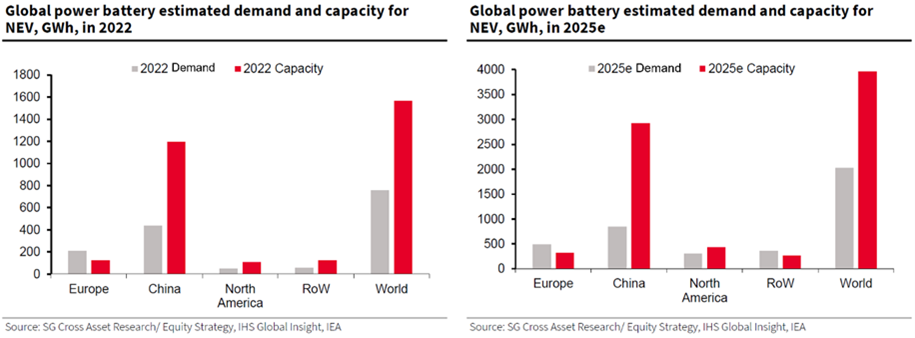

Supply-side policies, however, risk creating other problems, such as overcapacity. Take green mobility, where China also dominates: Societe Generale research forecasts that global demand for EV batteries will reach 2,030 gigawatt hours (GWh) by 2025, while production capacity will reach 3,970 GWh. For China, production capacity could be as much as 3.5 times domestic demand.

On the other hand, Japan has wagered on technological innovation to decarbonise its power sector. Japan still depends on fossil fuels for over 70% of power supply, which is responsible for about half of the country’s CO2 emissions. In addition to renewables, the national strategy focuses on technologies such as hydrogen, ammonia, nuclear and CCUS (carbon capture, utilisation and storage).

Across Asia Pacific, the clean energy sector is constantly evolving as technologies are upgraded and the global transition progresses. Adding to the complexity, geopolitical tussles and trade dynamics are reshaping the value chains supporting Asia’s green transition, as governments, especially in the West, look to reduce dependencies on imported commodities and components, encourage recycling, and shift towards onshoring and nearshoring.

“As we can see from economies across Asia, there are many ways to reach net zero, not just one ‘right’ way,” says Yao.

Seeking opportunities in transition

After clean energy thematics weathered headwinds in 2023, due to a combination of high inflation and rising interest rates, the question is whether such themes are still good investments in 2024.

“The good news is that valuations have fallen more than earnings, which removes the large premium on green transition stocks,” says Frank Benzimra, Head of Asia Equity Strategy and Multi-Asset Strategist. “The sector continues to enjoy strong policy support, and a friendlier rates environment could benefit the growth investment cycle in 2024.”

Climate analytics, such as the Climate Value-at-Risk, can be applied to help investors reduce exposure to companies with higher transition risk or identify those with lower transition risk.

The transition from ‘brown’ to ‘green’ activities is increasingly drawing attention from institutional investors, especially those with exposure to Asia. The transition bond market, although still nascent with no standardised definition, is growing fast and attracting attention from investors internationally.

Japan, for example, has become the largest source of transition bond issuance , and has set the standard by introducing one of the world’s first transition taxonomies. The government recently committed to achieving ¥150 trillion ($1 trillion) of public-private investments over 10 years, ¥20 trillion of which will be funded by sovereign transition bonds. The first sovereign transition bond auction took place on 14 February 2024 .

Frameworks, metrics and third-party trust are key considerations for investors when assessing if the transition targets are ambitious enough and track records robust.

The green transition in Asia is a complex topic, with different countries moving in different directions. Despite the challenges of geopolitics and rapid technological advancement, the green transition presents vast opportunities and will continue to be a promising theme for investors.

1. https://www.ft.com/content/8927424e-2828-4414-86b7-f3a991214288

2. IEA, CO2 emissions from fuel combustion, global ranking, 2021; BP Statistical Review (2022), Carbon dioxide emissions from energy, 2021 share

3. 2020 data, United Nations World Population Prospects 2022

4. https://www.mas.gov.sg/news/speeches/2023/developing-the-ecosystem-for-energy-transition

5. Based on data from Bloomberg, as of 16 Jan 2024.

6. https://www.mof.go.jp/english/policy/jgbs/topics/press_release/20231207-001e.htm