Sustainable & Positive Impact Finance

Display allNEWS and PRVideos

02

Feb

2026

Supporting biomethane production in Spain and Italy

By securing EUR 671 million in financing, Verdalia Bioenergy can continue its development through the construction and...

By securing EUR 671 million in financing, Verdalia Bioenergy can continue its development through the construction and...

Clients' successes

By securing EUR 671 million in financing, Verdalia Bioenergy can continue its development through the construction and acquisition of several biomethane production sites in Spain and Italy.

Supporting biomethane production in Spain and Italy16

Jan

2026

Navigating New Frontiers: The Evolving Role of Treasurers in a Complex World

Welcome to this new whitepaper, in which we bring together four of today’s most pressing topics for corporate...

Welcome to this new whitepaper, in which we bring together four of today’s most pressing topics for corporate...

Expert views

Welcome to this new whitepaper, in which we bring together four of today’s most pressing topics for corporate treasurers. All are connected, in the midst of ongoing global trading uncertainty, by the urgency with which each must be tackled, whether in risk mitigation or in the leveraging of opportunity.

Navigating New Frontiers: The Evolving Role of Treasurers in a Complex World10

Nov

2025

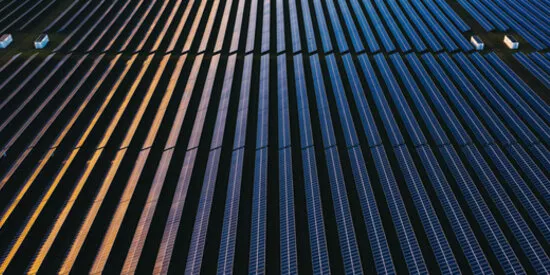

Meeting Big Tech’s Clean Energy Demand Through Solar in the U.S.

The energy intensiveness of data centers creates both a challenge and an opportunity for leaders in the renewable...

The energy intensiveness of data centers creates both a challenge and an opportunity for leaders in the renewable...

Clients' successes

The energy intensiveness of data centers creates both a challenge and an opportunity for leaders in the renewable technology sector and energy transition-minded banks like Societe Generale. The Bank led alongside Canadian Imperial Bank of Commerce (CIBC) the ~$510 million debt financing for Longroad Energy’s 1000 Mile solar project in Texas, designed to help...

Meeting Big Tech’s Clean Energy Demand Through Solar in the U.S.03

Nov

2025

Accelerating Infrastructure Transformation on College Campuses Across the United States

Universities across the U.S. are transforming their infrastructure to meet energy and reliability goals. With rising...

Universities across the U.S. are transforming their infrastructure to meet energy and reliability goals. With rising...

Clients' successes

Universities across the U.S. are transforming their infrastructure to meet energy and reliability goals. With rising demands and aging systems, many are turning to public-private partnerships (P3s) to modernize utilities, reduce emissions, and improve efficiency. Societe Generale is helping lead this shift, financing innovative campus solutions that support...

Accelerating Infrastructure Transformation on College Campuses Across the United States28

Oct

2025

Turning Carbon Removal into a Bankable Asset Class

As demand for net-zero strategies grows, nature-based carbon credits are gaining traction—supported by innovative...

As demand for net-zero strategies grows, nature-based carbon credits are gaining traction—supported by innovative...

Clients' successes

As demand for net-zero strategies grows, nature-based carbon credits are gaining traction—supported by innovative financing and a rapidly expanding voluntary market. Chestnut Carbon (“Chestnut”), a leader in the nature-based carbon removal sector, exemplifies the growth and potential of the market. Societe Generale participated as Lender in the development of...

Turning Carbon Removal into a Bankable Asset Class06

Oct

2025

Supporting the transformation of the cruise industry

Societe Generale has supported MSC Cruises (MSCC), one of the world's leading cruise companies, in the financing of two...

Societe Generale has supported MSC Cruises (MSCC), one of the world's leading cruise companies, in the financing of two...

Clients' successes

Societe Generale has supported MSC Cruises (MSCC), one of the world's leading cruise companies, in the financing of two new generation cruise ships.

Supporting the transformation of the cruise industry10

Sep

2025

India’s decarbonisation drive: From ambition to action

Fast-growing India provided the ideal setting for Societe Generale’s first Positive Impact Day of 2025, bringing...

Fast-growing India provided the ideal setting for Societe Generale’s first Positive Impact Day of 2025, bringing...

News

Fast-growing India provided the ideal setting for Societe Generale’s first Positive Impact Day of 2025, bringing together business leaders and industry experts to discuss India’s pivotal role in global decarbonisation.

India’s decarbonisation drive: From ambition to action31

Mar

2025

Supporting a hydrogen emerging leader in Germany

Electrolyzers, which use electricity to split water into hydrogen and oxygen, are a critical technology for producing...

Electrolyzers, which use electricity to split water into hydrogen and oxygen, are a critical technology for producing...

Clients' successes

Electrolyzers, which use electricity to split water into hydrogen and oxygen, are a critical technology for producing green hydrogen from renewable electricity. Sunfire, one of the world’s leading electrolysis companies, secured a EUR 200 million guarantee financing with the support from Societe Generale.

Supporting a hydrogen emerging leader in Germany25

Mar

2025

Powering the Data Center Boom in the US

The rapid evolution of artificial intelligence is driving an unprecedented need for high-performance computing...

The rapid evolution of artificial intelligence is driving an unprecedented need for high-performance computing...

Clients' successes

The rapid evolution of artificial intelligence is driving an unprecedented need for high-performance computing infrastructure. Societe Generale recently led the successful USD 600 million debt financing for a new AI and HPC (high-performance computing) data center project leased to CoreWeave, sponsored by Blue Owl, Chirisa Technology Parks and PowerHouse Data...

Powering the Data Center Boom in the US