Trade receivables

Definition

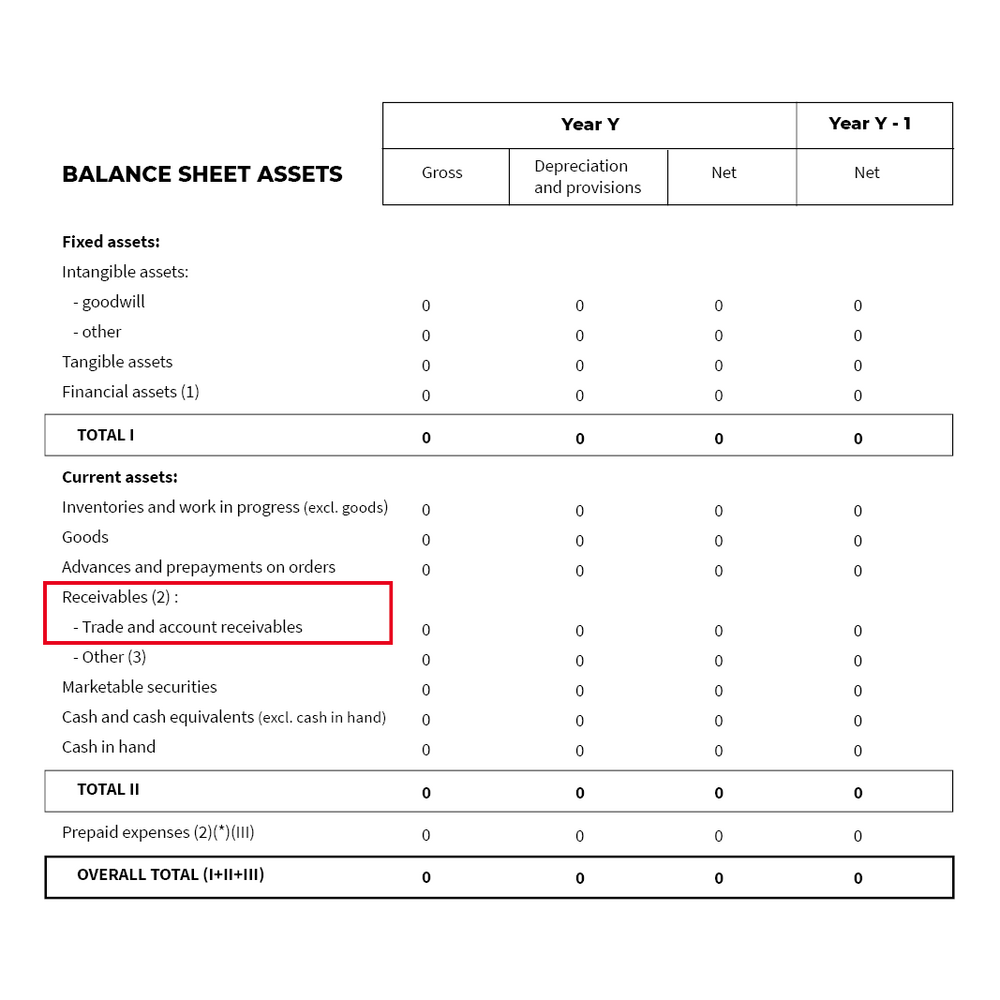

Trade receivables represent the total amounts that a company has invoiced to customers for goods and services that it has delivered but for which it has not yet received payment. As such, trade receivables are included on the assets side of the balance sheet within current assets. They are contrasted with trade payables.

Calculation

It should be noted that from this aggregate, a ratio is determined that is very much used in financial analysis, which is called "customer delays". The formula for calculating this ratio is as follows: Delayed receivables = (Total amount of trade receivables including VAT / Sales including VAT) * 360.

Example: a company has EUR 1m of trade receivables including VAT; its turnover including VAT is EUR 5m . From there, its DSO ratio is DSO = (1,000,000/5,000,000) * 360 = 72 days of sales including VAT.

This ratio means that on average, the company collects its sales revenue after 72 days.

Interest on trade receivables

Trade receivables are an important item for both companies and their bankers. The cash flow needs depend partly on the good management of these trade receivables.

Thus, all things being equal, a company's cash flow is improved by reducing the amount of its trade receivables. Credit institutions therefore offer solutions that enable the amount of trade receivables to be reduced, in particular through the discounting of documentary credit (trade finance) or the mobilization of trade receivables or the customer item (factoring).

Our latest news and insights

As part of the 2026 TMI Awards for Innovation & Excellence, Societe Generale is proud to have won the Technology &...

Northern Virginia’s “Data Center Alley” remains the leading hub for hyperscale data centers in the US, but rising AI...

By Pierre Carassus, Head of Maritime Industries, Asia-Pacific at Societe Generale.