Asset finance

What is asset finance?

Asset financing is a structured financing solution. It allows companies to finance the purchase of assets such as aircrafts, ships, trains and, in some cases, real estate. These are medium-to long-term financing projects.

Let's take the example of an airline company wishing to acquire an aircraft. There are several options:

- The company borrows directly for this acquisition, and the debt appears on the balance sheet.

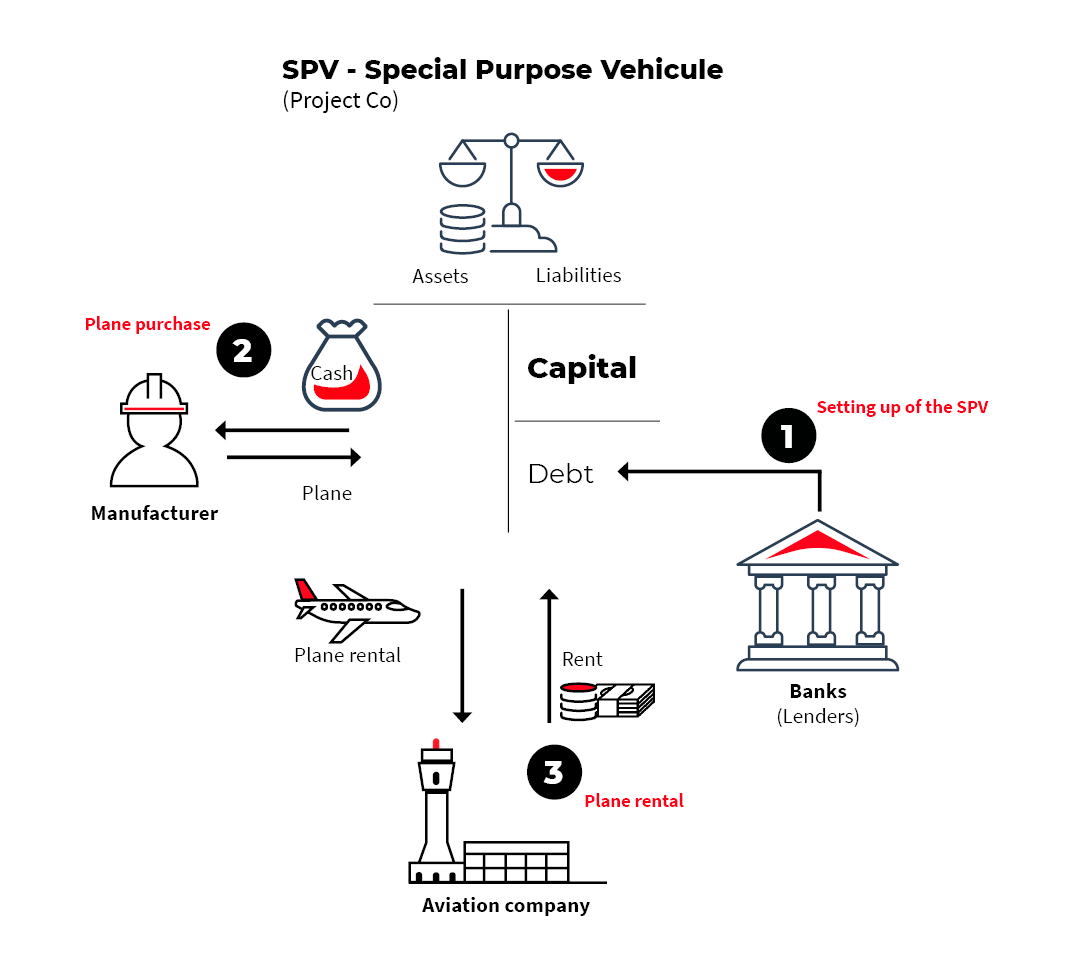

- Alternative option: create a special purpose vehicle (SPV) that takes on the debt for the aircraft purchase. This aircraft is then leased to the airline by the SPV. The lease payments are used to repay the SPV’s debt. Once the debt is repaid, the airline has an option to purchase the aircraft at its residual value. This is a lease arrangement can take different forms.

What are the benefits of asset finance?

For the acquiring company, there are multiple advantages:

- Use of the asset without having to go into debt, for a moderate rent;

- Reduction of risks in the event of project underperformance, since the loss is limited to the amount of equity contributed to the SPV (unlike a direct loan contracted by the company);

- Financing of substantial projects with minimal contribution, since debt represents a significant share of the financing and the client(s) only provide the equity;

- Distribution of risks and expertise among different stakeholders, since the SPV can be owned by several companies;

- The debt of the SPV is generally provided by several banks or institutional investors in order to mutualize/share the risks.

What is the bank’s role in asset finance?

The bank acts as an adviser. It helps to structure the SPV by defining the risks of non-payment of lease, which corresponds to a corporate risk and the cost of refurbishing the asset in order to be able to resell or re-lease it.

The bank provides the debt of the SPV alone in the case of a bilateral financing or with several parties in the case of a syndicated financing. It may also act as an agent, i.e., as an intermediary between the client and the project’s lenders.