Decarbonisation trends within the Trade Commodity Finance sector

3 questions to Deia Markova, Head of Trade Commodity Finance and Sustainability ambassador at Societe Generale in Switzerland

Deia Markova, how has the commodities trade sector evolved the past few years?

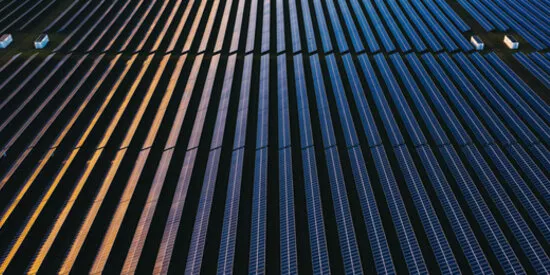

We are witnessing a historical shift, from a predominantly fossil fuel-based energy system to a material-intensive energy system. The technologies, essential for the energy transition, are mineral-intensive, requiring large amount of base and niche metals. At the same time, the net-zero commitments are outpacing the formation of supply chains, market mechanisms, financing models and other solutions needed to smooth the world’s decarbonisation pathway. The whole sector will be put under test. It will have to provide numerous raw materials required for the energy transition, adapt to new technologies and must also decarbonise its own operations, all at the same time. Solutions are complex and the banks’ role is to co-construct those with clients and partners.

What are the current trends you can identify?

It is true that decarbonisation is a central topic for our industry. There are also many discussions about the place of technology in the energy transition. For me technology is first and foremost an enabler in the energy transition, there to help pivot the current system. Counter-intuitively, it is low-tech solutions that decarbonise our economy the most, but this can be more efficient through the use of advanced technologies.

If we look at trading companies, Scope 1 and Scope 2 emissions (direct emissions linked to the company activity) can often be measured relatively easily. Measuring Scope 3 emissions, which are indirect emissions, covering the whole value chain is a more complex task, involving the collection of the required activity data and appropriate emission factors, and can represent a significant effort. In my view, it is the right playfield for collaboration with technology.

What are our clients’ needs and how can we help them?

Let me give you a concrete example of how we support the decarbonisation journey of several of our commodity trading clients in a very pragmatic and innovative way using technology. We work together with CarbonChain and clients, using big data and machine learning technologies to measure the GHG (Greenhouse gas) emissions of selected trade flows via a mapping of the full supply chain. This mapping gives both our clients and us a better understanding and transparency of their company's current carbon footprint at each stage of a transaction (in the warehouse, in the port, on the ship…). It also creates the necessary auditability level and comparability to benchmarks. We started this project because the relevant data did not exist. This was the critical first step in implementing the reduction ambitions with our clients. Based on the results, we set up KPIs based on CarbonChain’s traffic light ratings (green, amber, red), which are assigned to each trade based on its performance against industry benchmarks for the relevant commodity. For example, a copper trade with a carbon intensity 20% better (lower) than the industry benchmark is given a Green Trade Rating. All production emissions are accounted for, from mine to finished product. This ensures the KPIs cover the most important and relevant sources of emissions and climate risks in an end-to-end trade supply chain.

To achieve success on two of the critical key performance indicators, our clients need to increase the proportion of Green-assigned trades and decrease the proportion of Red- and Amber- assigned trades across their entire trade portfolio — and not just those financed by Societe Generale. It is a long-term process, it can sometimes be complex, but we remain committed to continue supporting our clients in their decarbonisation journey.