Is it equity value's time, finally?

Following months of breakneck gains in equities on the back of expected deeper monetary easing and the AI-fueled momentum in economic growth, markets are suddenly stalling with bearish overhang as a result of concerns about tariffs, renewed inflation and its negative outlook for the rate path.

One equity strategy, however, may be primed for its moment if history is any indication.

“It’s conventional wisdom that Equity Value does well during periods of prospective economic growth in early economic recovery,” says Solomon Tadesse, Head of Equity Quant Research at Societe Generale Americas. “Historically, its performance strongly correlates with rising bond yields because they indicate future economic growth.”

But another thing going for Equity Value during our current state of market uncertainty is that this basket of stocks has also proven resilient and often rebounds during most tail events, exhibiting critical defensive characteristics, according to Societe Generale Research.

“Our research suggests that Equity Value outperforms the broad market in times of both large upward and downward swings,” says Tadesse.

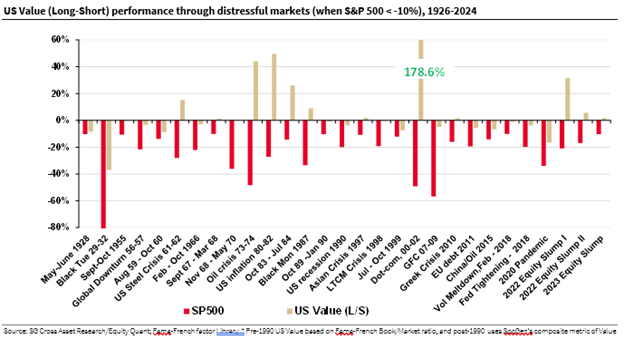

According to Societe Generale Research, during periods of market distress (defined as episodes in which the S&P 500 registered a -10% return or more), US Value had resilient performance, often rallying in the midst of crises (figure below).

“This was evident particularly during the inflation-induced crises of the 1970s and early 80s, reminiscent of the macro backdrop of the present,” says Tadesse.

Implementing a Value strategy may present its unique challenges, though, as the Value basket of stocks could often be burdened by junk – the classic deep-value trap. Therefore, a filtered Value strategy could be the solution.

“In any case,” says Tadesse, “time will tell if Equity Value repeats its century-long history of performance during this cycle of potential market correction.”