ESG DATA FOR INVESTORS: WHAT'S NEEDED TO SCALE UP

This article explores why there is still a need to foster the quality and accessibility of ESG data to be embedded in investment solutions and risk management.

In the ever-evolving world of finance, environmental, social, and governance (ESG) factors have emerged as essential components of modern investment strategies. Navigating the ESG data space, however, remains a mine field for those seeking consistent, reliable, financially relevant and timely information for investment opportunities, product development and commitment tracking.

Demand for quality ESG data on the rise

Global investors, both fundamental and systematic, are increasingly incorporating ESG metrics (including ESG Ratings) as an additional set of data to manage investment risk and identify pockets of growth opportunities. A recent survey by Bloomberg indicated that more than 9 in 10 executives at financial institutions (FIs) such as asset managers and banks plan to increase ESG data spending by at least 10%. This increase also comes at a time when the ESG data and analytics market is experiencing rapid growth in the past few years, driven by an evolving regulatory landscape and industry standards.

As regulators in major markets work to set expectations for sustainability-related financial risk disclosures, listed and/or large companies are being required to report on their own sustainability and that of their supply chain. The historically fragmented ESG disclosure standards are beginning to converge with the introduction of the IFRS Sustainability Disclosure Standards, which require companies to disclose information about sustainability-related risks and opportunities that could affect the company's cash flows and access to capital in the short, medium, and long term.

Despite these exciting developments, investors remain concerned about key challenges such as the transparency of the methodology, quality and comparability of the data, whether the data offers forward-looking and actionable insights, and the accessibility / interoperability of the data.

9 in 10 executives at financial institutions (FIs) such as asset managers and banks plan to increase ESG data spending by at least 10%.

- ESG Data Acquisition & Management Survey 2023

Societe Generale's response

Recognising this trend and the growing appetite for ESG data with insights, Societe Generale's ESG specialists and technology experts at Global Markets have worked together to develop innovative analytics solutions with a unique combination of in-depth sustainability expertise, deep capital markets knowledge and understanding of data science and engineering.

This is why Global Markets has added a range of ESG datasets to its existing award-winning SG Analytics platform, which is primarily focused on making Societe Generale's market data available to clients for strategy design and execution, risk management, and post-trade. Data, including those related to ESG on the SG Analytics platform, can easily be customized at different levels to suit the needs of the users.

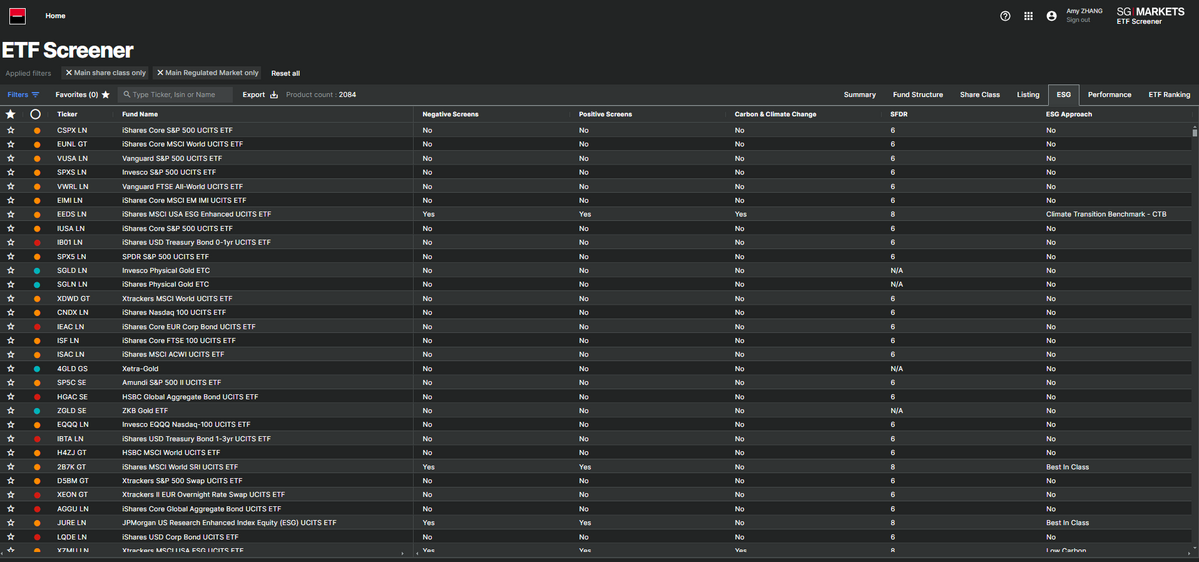

Usage case studies: ESG Analytics: Sustainable Bond Screener

The Sustainable Bond Screener covers a universe of Euro-denominated sustainable bonds from major indices. Users can track the change of the greenium over time by comparing the Z-spread of a sustainable bond to a conventional bond and identify trading opportunities.

The tool uses proprietary daily pricing data, and its methods and assumptions are explained in detail upon request. Users can also download the data for further analysis, making it a comprehensive and accessible tool for tracking sustainable bonds.

Image 1: Interface of the Sustainable Bond Screener

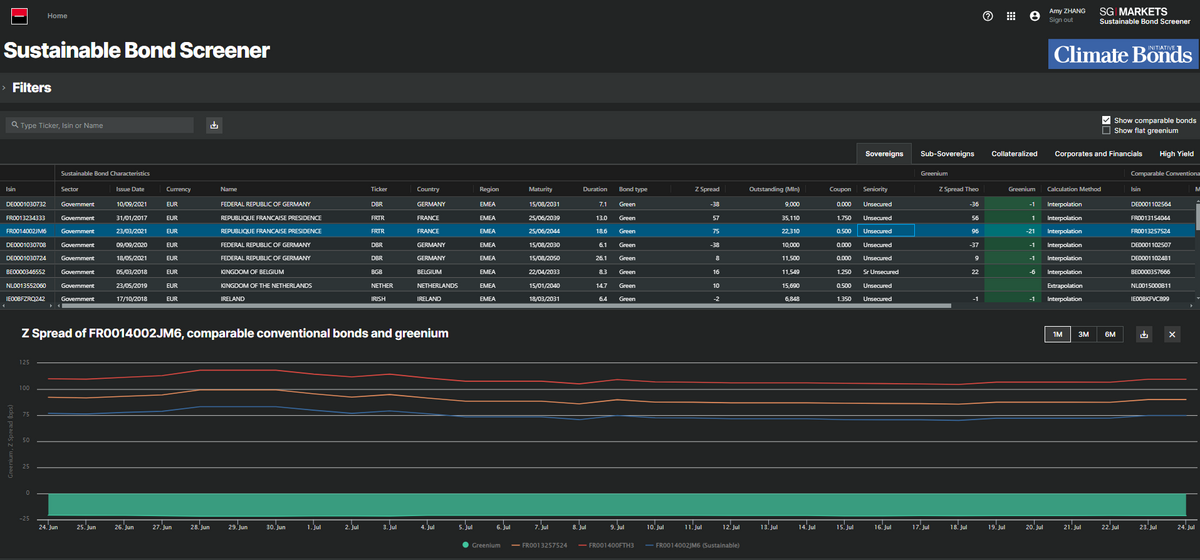

Example 2: ECB climate replication scores

In July 2022, the European Central Bank (ECB) introduced a scoring methodology to assess the climate performance of each eligible issuer with an aim to gradually decarbonize its corporate bond holdings to align with the Paris Agreement. The scoring methodology is based on three sub-scores:

- Backward-looking emission sub-score

- Forward-looking emission sub-score

- Disclosure quality sub-score

Since the details about the scoring methodology are not fully public, Societe Generale has replicated the scores as closely as possible to the ECB’s methodology, to assess the climate profile of issuers and predict which issuers / bonds are likely to be tilted towards or away from in the ECB’s next purchase. The replication of the methodology provides a unique forward-looking angle, which precisely addressed the key concerns of investors – credibility of decarbonization commitment of issuers.

Image 2: Overview of the ECB’s methodology used for the climate score ; Chart Source: ECB

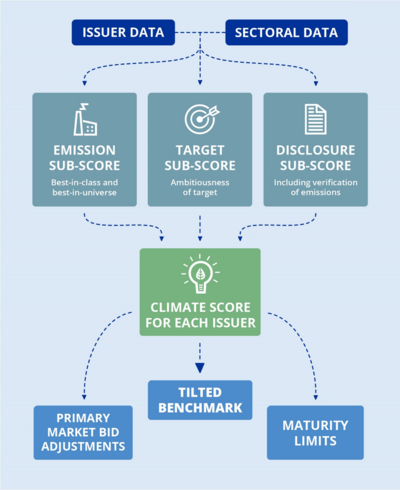

Example 3: ETF Screener (with ESG filter)

Covering a universe of over 2,000 Europe-domiciled exchange-traded funds (ETFs) and physically-backed exchange-traded commodities (ETC), ETF Screener is a pre-trade analytics tool designed to help investors select the ETFs that best meet their needs. ESG-focused ETFs can be easily identified, using various ESG-centric filters based on ESG approach (exclusions only, best in class, low carbon and climate change) and SFDR (Sustainable Finance Disclosure Regulation) disclosures.

Image 3: ETF Screener (with ESG filter)

Fostering a data-driven future for ESG investing

Societe Generale accredits the success of its ESG data and analytics capabilities to the innovation and agility of its people, technology, and processes.

As early as 2006, Societe Generale was among the pioneers to set up a research team dedicated to sustainability matters within its Global Market Activities. We were among the first to stress that long-term value creation depended on much more than short-term profitability or the allocation of financial capital. Fast forward to the present, Bernstein Societe Generale Group this year created a Leader in Global Cash Equities & Equity Research that shares the DNA of innovation and excellence.

Image 4: Success drivers for Societe Generale's ESG Analytics platform

There is still some way to go to ensure that all stakeholders have access to reliable and accurate information. One of the ways the Bank is doing this is with artificial intelligence (AI). ESG analysis is being enhanced by rapid advancements in AI, which is turbocharging the growth and diversification of data products and analytical solutions. Capitalising on the rapid development of AI, which has led to the popularity of certain AI tools such as ChatGPT and Gemini, Societe Generale is working to improve its own in-house Gen-AI bot to make information, including ESG information, more accessible and time-efficient.

By fostering an ecosystem that encourages product development, sustainability disclosures, and decarbonization support, the bank is dedicated to generating long-term value for its clients and contributing to a more sustainable future.

The Bank is also looking to streamline the integration of ESG data. Currently, investors can easily access stand-alone ESG datasets, but having a mix of datasets containing ESG data, market data and other data (e.g., index composition) from different providers in one place is more complicated for blending and integration. The challenge is compounded by the fact that different providers use different methodologies and face limitations, which makes the selection of provider(s) key. Internally, there are significant efforts to integrate ESG data and analyses more organically into our processes to improve its operationalisation through various programmes.

The SG Data & Analytics platform is poised to lead the way in the global capital markets, providing clients with valuable ESG insights and helping them navigate the complexities of ESG investing. By fostering an ecosystem that encourages product development, sustainability disclosures, and decarbonization support, the bank is dedicated to generating long-term value for its clients and contributing to a more sustainable future.

***

Ready to take the first step towards a more sustainable and profitable future? Visit our website or contact one of our ESG specialists to learn more about our innovative ESG analytics tools and resources.