Video library

Learn more with our experts point of view, animated movies and discover how banking works through educational videos

30

Aug

2022

Infrastructure - EV charging stations

Supporting the development of charging infrastructures, we accompany our clients’ projects to provide necessary...

Supporting the development of charging infrastructures, we accompany our clients’ projects to provide necessary...

Supporting the economy

Supporting the development of charging infrastructures, we accompany our clients’ projects to provide necessary territorial coverage and facilitate the electric mobility.

Infrastructure - EV charging stations11

Jul

2022

Is there too much risk in retirement?

For more information, contact us.

For more information, contact us.

03

Jun

2022

Financing a better future

Climate change, social inclusion, the development of emerging economies, the smart use of scarce resources are among the...

Climate change, social inclusion, the development of emerging economies, the smart use of scarce resources are among the...

Alternative Funds Services

Climate change, social inclusion, the development of emerging economies, the smart use of scarce resources are among the crucial challenges the whole world faces today, for a better future, for the legacy we will leave to the next generations.

Highly supportive of transitioning to a fairer & greener economy, Societe Generale stands by its clients to help...

Financing a better future24

Mar

2022

Societe Generale SRP 2022 Awards

Presentation of the awards won by Societe Generale at the SRP 2022 Awards.

Presentation of the awards won by Societe Generale at the SRP 2022 Awards.

Alternative Funds Services

Presentation of the awards won by Societe Generale at the SRP 2022 Awards.

Societe Generale SRP 2022 Awards 10

Mar

2022

Solutions and organization of the Corporate department at Societe Generale Factoring

Find in video the solutions and organization of the Corporate department at Societe Generale Factoring presented by...

Find in video the solutions and organization of the Corporate department at Societe Generale Factoring presented by...

Receivables and supply chain finance

Find in video the solutions and organization of the Corporate department at Societe Generale Factoring presented by Edouard de Guyenro and Philippe Patriarca

Solutions and organization of the Corporate department at Societe Generale Factoring25

Feb

2022

Payment & Transaction Banking Accelerator by SG

The program, Payment & Transaction Banking Accelerator by SG (P&T BAX), is entirely dedicated to Trade Finance, Cash...

The program, Payment & Transaction Banking Accelerator by SG (P&T BAX), is entirely dedicated to Trade Finance, Cash...

Alternative Funds Services

The program, Payment & Transaction Banking Accelerator by SG (P&T BAX), is entirely dedicated to Trade Finance, Cash Management, Factoring, and Cash Clearing & Correspondent Banking activities.

Payment & Transaction Banking Accelerator by SG17

Jan

2022

Pioneering ESG Research & Solutions

Climate change, social inclusion, the development of emerging economies, scarce resources, we all need to act now.

Climate change, social inclusion, the development of emerging economies, scarce resources, we all need to act now.

Alternative Funds Services

Climate change, social inclusion, the development of emerging economies, scarce resources, we all need to act now.

Pioneering ESG Research & Solutions12

Jan

2022

Discover the 2022 Emerging Currency and Fixed Income Guide

Discover the 2022 Emerging Currency and Fixed Income Guide, an all-encompassing guide to Societe Generale's Emerging...

Discover the 2022 Emerging Currency and Fixed Income Guide, an all-encompassing guide to Societe Generale's Emerging...

Alternative Funds Services

Discover the 2022 Emerging Currency and Fixed Income Guide, an all-encompassing guide to Societe Generale's Emerging Markets offer.

Discover the 2022 Emerging Currency and Fixed Income Guide02

Dec

2021

Emerging Markets Currencies Guide

Introduction to the Emerging Markets Currencies Guide.

Introduction to the Emerging Markets Currencies Guide.

Alternative Funds Services

Introduction to the Emerging Markets Currencies Guide.

Emerging Markets Currencies Guide23

Nov

2021

Is Hydrogen the key to unlocking net zero?

Quite a topical question, but before answering it, let’s look at the fundamentals of this element. What is hydrogen and...

Quite a topical question, but before answering it, let’s look at the fundamentals of this element. What is hydrogen and...

Supporting the economy

Quite a topical question, but before answering it, let’s look at the fundamentals of this element. What is hydrogen and what makes it green?

Is Hydrogen the key to unlocking net zero?29

Mar

2021

Focus on “GPI CASE RESOLUTION SERVICE”

Our expert, Laurent Collinot, Product Manager, Cash Clearing Services at Societe Generale, shares his views in this...

Our expert, Laurent Collinot, Product Manager, Cash Clearing Services at Societe Generale, shares his views in this...

Cash Clearing

Our expert, Laurent Collinot, Product Manager, Cash Clearing Services at Societe Generale, shares his views in this short video "3 questions, 1 coffee".

Focus on “GPI CASE RESOLUTION SERVICE” 04

Nov

2020

Supply chain finance - Banking's next decade Ch 4/4

Marie-Laure Gastellu, global head of trade finance and services at Societe Generale, speaks to James King about the...

Marie-Laure Gastellu, global head of trade finance and services at Societe Generale, speaks to James King about the...

Alternative Funds Services

Marie-Laure Gastellu, global head of trade finance and services at Societe Generale, speaks to James King about the outlook for supply chain finance in the wake of the Covid-19 pandemic and the steps banks are taking to better serve their clients in a changing world.

Supply chain finance - Banking's next decade Ch 4/404

Nov

2020

Green trade finance - Banking's next decade Ch 3/4

Marie-Laure Gastellu, global head of trade finance and services at Societe Generale, discusses the development of green...

Marie-Laure Gastellu, global head of trade finance and services at Societe Generale, discusses the development of green...

Alternative Funds Services

Marie-Laure Gastellu, global head of trade finance and services at Societe Generale, discusses the development of green trade finance including efforts to develop globally recognised standards, as well as increasing customer demand for green trade finance solutions.

Green trade finance - Banking's next decade Ch 3/404

Nov

2020

Rethinking correspondent banking - Banking's next decade Ch 2/4

Jean-François Mazure, head of cash clearing and correspondent banking at Societe Generale, speaks to James King about...

Jean-François Mazure, head of cash clearing and correspondent banking at Societe Generale, speaks to James King about...

Cash Clearing

Jean-François Mazure, head of cash clearing and correspondent banking at Societe Generale, speaks to James King about the future of correspondent banking and the ways in which banks and new entrants are rethinking the traditional correspondent banking business model.

Rethinking correspondent banking - Banking's next decade Ch 2/404

Nov

2020

The correspondent banking landscape - Banking's next decade Ch 1/4

Jean-François Mazure, head of cash clearing and correspondent banking at Societe Generale, talks to James King about the...

Jean-François Mazure, head of cash clearing and correspondent banking at Societe Generale, talks to James King about the...

Cash Clearing

Jean-François Mazure, head of cash clearing and correspondent banking at Societe Generale, talks to James King about the impact of the Covid-19 pandemic on the contemporary correspondent banking landscape.

The correspondent banking landscape - Banking's next decade Ch 1/406

Jul

2020

Focus on Instant payment

Focus on Instant payment: The continuous Innovation journey of Societe Generale. Our expert, Frantz Teissedre, Head of...

Focus on Instant payment: The continuous Innovation journey of Societe Generale. Our expert, Frantz Teissedre, Head of...

Cash Clearing

Focus on Instant payment: The continuous Innovation journey of Societe Generale. Our expert, Frantz Teissedre, Head of Interbank Relationships, Societe Generale shares his views in this short video "3 questions, 1 coffee".

Focus on Instant payment20

May

2020

FX Morning expresso

Markets never sleep. Our Morning expresso is, as it should be, a short and sharp look at what financial markets have in...

Markets never sleep. Our Morning expresso is, as it should be, a short and sharp look at what financial markets have in...

Global Economic Outlook

Markets never sleep. Our Morning expresso is, as it should be, a short and sharp look at what financial markets have in store for the day.

FX Morning expresso06

May

2020

How SG is preparing for this new payment format

How SG is preparing for this new payment format

How SG is preparing for this new payment format

Cash Clearing

How SG is preparing for this new payment format

How SG is preparing for this new payment format20

Apr

2020

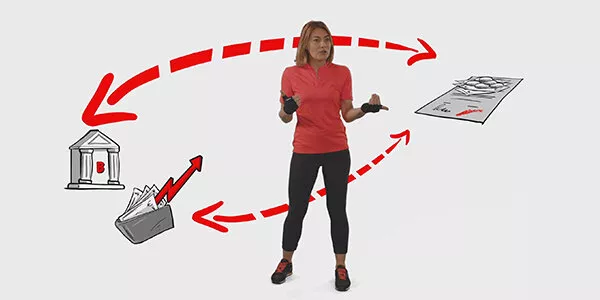

AUTO FX SOLUTION

Auto FX is the solution to manage your costs, protect your customers and generate revenue.

Auto FX is the solution to manage your costs, protect your customers and generate revenue.

Alternative Funds Services

Auto FX is the solution to manage your costs, protect your customers and generate revenue.

AUTO FX SOLUTION12

Mar

2020

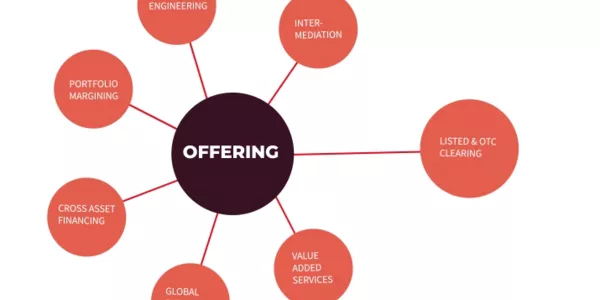

Prime services infographics

Prime services

Prime services

09

Mar

2020

Will satellites become the eyes of sustainable investing?

Eyes in the sky don’t lie. As investors seek more information about businesses’ environmental impacts, they have a new...

Eyes in the sky don’t lie. As investors seek more information about businesses’ environmental impacts, they have a new...

ESGDAYS

Eyes in the sky don’t lie. As investors seek more information about businesses’ environmental impacts, they have a new source: satellite imagery.

Will satellites become the eyes of sustainable investing?09

Mar

2020

Going beyond green bonds to finance sustainable development in emerging economies

While green bonds grab the news headlines for financing sustainable development in emerging economies, in fact they are...

While green bonds grab the news headlines for financing sustainable development in emerging economies, in fact they are...

ESGDAYS

While green bonds grab the news headlines for financing sustainable development in emerging economies, in fact they are a small part of the picture.

Going beyond green bonds to finance sustainable development in emerging economies28

Feb

2020

16 - What is an ETF?

An exchange-traded fund (ETF) tracks benchmark indexes like the CAC 40. ETF managers do not have to pick between...

An exchange-traded fund (ETF) tracks benchmark indexes like the CAC 40. ETF managers do not have to pick between...

Banktionary

An exchange-traded fund (ETF) tracks benchmark indexes like the CAC 40. ETF managers do not have to pick between different stocks; they just follow the index according to its composition. ETFs are traded on the market just like shares.

16 - What is an ETF?28

Feb

2020

15 - What is a primary dealer bank?

Each month, a “primary dealer” helps countries renew their debts as they reach maturity. To do this, the Ministry of...

Each month, a “primary dealer” helps countries renew their debts as they reach maturity. To do this, the Ministry of...

Banktionary

Each month, a “primary dealer” helps countries renew their debts as they reach maturity. To do this, the Ministry of Finance calls on primary dealer banks whose mission is to find investors interested in buying these debts.

15 - What is a primary dealer bank?28

Feb

2020

14 - What is collateral management?

Collateral management is a technique the bank uses to quickly identify what can be committed as collateral so that a...

Collateral management is a technique the bank uses to quickly identify what can be committed as collateral so that a...

Banktionary

Collateral management is a technique the bank uses to quickly identify what can be committed as collateral so that a transaction can be performed. When a company needs a lot of cash, to pay a supplier for instance, the bank will ask the business to commit part of its equity portfolio as collateral to secure the loan. Thanks to its expertise, the bank can...

14 - What is collateral management?28

Feb

2020

13 - What is a hedge fund?

A hedge fund is defined as more flexible than most common funds, which are usually benchmarked to an index like the...

A hedge fund is defined as more flexible than most common funds, which are usually benchmarked to an index like the...

Banktionary

A hedge fund is defined as more flexible than most common funds, which are usually benchmarked to an index like the CAC40 and try to outperform it. A hedge fund aims to achieve a stable performance of 10% every year by investing in currencies, bonds and other assets to avoid a loss.

13 - What is a hedge fund?28

Feb

2020

12 - How are banks involved in M&A transactions?

M&A stands for Mergers and Acquisitions. It defines the buyout or the fusion of two companies whose activities are...

M&A stands for Mergers and Acquisitions. It defines the buyout or the fusion of two companies whose activities are...

Banktionary

M&A stands for Mergers and Acquisitions. It defines the buyout or the fusion of two companies whose activities are similar. In this case, the bank has a crucial advisory role.

12 - How are banks involved in M&A transactions?28

Feb

2020

11 - What is a broker?

An equity broker works with a team of research analysts who constantly analyze the financial health of listed companies....

An equity broker works with a team of research analysts who constantly analyze the financial health of listed companies....

Banktionary

An equity broker works with a team of research analysts who constantly analyze the financial health of listed companies. Clients can base their orders on their financial analysis as sent by their broker. Their broker can also help them with their orders and the terms of execution.

11 - What is a broker?

More results

google link