Supporting one of Italy's largest Biomethane Platforms

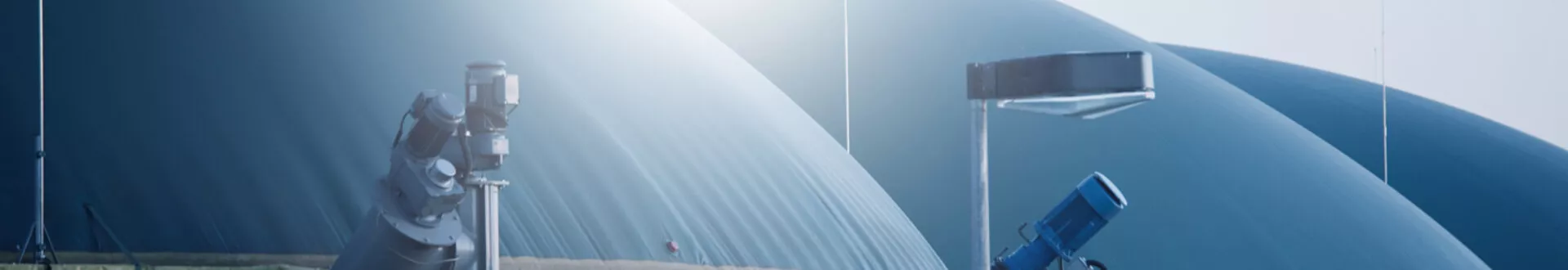

Retina Holding secured the financing of one of the largest biomethane portfolios in Italy with strong ESG characteristics, underpinned by a 15-year CfD subsidy from the Italian government. Societe Generale acted as Mandated Lead Arranger and Hedge Provider in this transaction which will create 9 biomethane plants across Italy for direct injection into the national gas transmission network.

Climate change and environmental degradation pose significant threats to Europe and the world. In response, the European Green Deal sets ambitious targets aiming at reducing net greenhouse gas emissions by at least 55% by 2030. Among identified solutions, biomethane emerges as an alternative, transforming organic and agriculture waste to create sustainable energy while cutting greenhouse gas emissions and reducing reliance on fossil fuels.

In Italy, the biomethane sector is underpinned by a favorable regulatory scheme providing for a 15-year Contract for Difference (CFD) tariff on the biomethane injected into the grid and a capital contribution of up to 40% of investment incurred.

Financing 9 biomethane plants across Italy

The uptake of biomethane involves the continued support of innovative technologies for the sustainable upgrade of biogas to biomethane and its integration into the gas network.

In this context, the partnership between Actarus Renewables and Eren Industries to develop one of the largest biomethane platforms in Italy marks a significant step forward in advancing sustainable solutions. This partnership will result in the design, construction, operations, and maintenance of 9 biomethane plants across Italy for direct injection into the national gas transmission network, biogenic CO2 recapture units, and organic fertiliser facilities.

Retina Holding owned by Retina SCA and Eren Industries, is a company specializing in the design, implementation, and management of infrastructure for biomethane production. It will operate this project and has successfully concluded a €240mn non-recourse financing, gathering the interest of 6 national and non-national lenders, with Societe Generale acting as Mandated Lead Arranger and Hedge Provider.

Retina SCA provided the initial equity funding whilst the developer Actarus Renewables and Macquarie Capital worked in partnership to underwrite the equity raise, secure the financing package, and provide operational support for the development of the platform.

The transaction will create one of the largest and most diversified biomethane portfolios in Italy, together with extensive production capabilities for compost and biogas production. The financing opportunity demonstrates ESG characteristics and contributes to the promotion of a circular economy, transforming agricultural waste into valuable energy resources.

Project Retina represents one of the largest biomethane portfolios in Italy, and the first biomethane transaction for Societe Generale in the European Union. It underlines the bank’s leading position in the clean energy transition industry and illustrates its ambition to be at the forefront of supporting emerging leaders for years to come. Furthermore, this transaction will benefit from the EIB Framework Loan Agreement signed by Societe Generale with the European Investment Bank (“EIB") dedicated to the financing of greenfield renewable energy projects, Leonardo Pecciarini, Head of Infrastructure and Energy Finance, Societe Generale Italy

Retina aims at becoming a key European player in a sector at the center of the EU plans to diversify energy sources, decrease reliance on imported fossil fuels and support Europe’s energy transition.

This transaction, supported by a pool of high profile domestic and international lenders is a key milestone for Retina in this journey and it is a testament to the strength of its platform, Franco Torra, General Manager of Retina