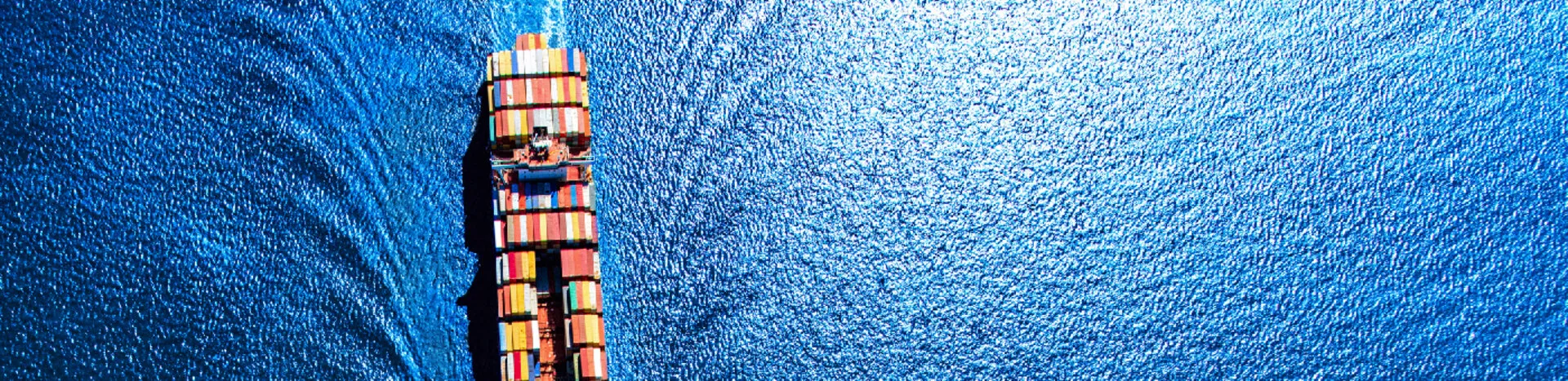

Eurazeo announces beginning of fundraising for dedicated vehicle supporting sustainable transition of the maritime sector and has appointed Societe Generale as advisor

Eurazeo is pleased to announce the start of fundraising for the “Eurazeo Maritime Transition Fund” and has appointed Societe Generale as advisor. This new financing vehicle, in the form of private debt fund, is dedicated to supporting the transition towards a more sustainable maritime sector.

Using a sale and leaseback scheme, covering up to 100% of asset value and up to 100% of retrofit costs, the debt fund finances both new vessels using alternative propulsion systems and existing on-the-water fleet retrofit & upgrades, thereby providing leading Tier-1 shipowners an attractive one-stop shop financing solution.

For new-build vessels, the focus lies on financing alternative / dual-fuel future proofed propulsion vessels that would use, for instance, Methanol, Ammonia or Hydrogen and on vessels equipped with wind-assisted propulsion systems. The financing of on-the-water vessels retrofits or upgrades, such as energy saving devices and efficiency improvements, will be subject to and measured against the emission reduction targets of the fund and will have the objective of improving efficiency for the remaining lifespan of the vessel.

The debt fund is expected to be launched early 2024 with the support of international institutional investors, pension funds, sovereign investors, and family offices. Investors will benefit from regular cash distributions and the strong integral protection provided through the real asset collateral and the high quality of financed counterparts.

Eurazeo will act as the General Partner (GP) and Alternative Investment Fund Manager (AIFM) of the fund, capitalizing on their expertise and track record in Fund Management, while Societe Generale will act as the sole adviser supporting fundraising and providing origination and advisory services, leveraging their vast maritime network and industry expertise.

As a founding member of the Poseidon Principles, which promote a low carbon future for the global shipping industry by integrating climate considerations into bank portfolios and credit decisions, and the UNEP-FI Net Zero Banking Alliance, Societe Generale is committed to working with its clients and partners across sectors to align its portfolios on trajectories to contribute to global carbon neutrality by 2050.

Eurazeo has been incorporating ESG into its business model for almost 20 years, positioning itself as a pioneer. It was also the first Private Equity player in Europe to commit to defining a decarbonization pathway with the Science Based Target initiative SBTi (both for the Group and for eligible portfolio companies). Eurazeo is also a founding member of initiative Carbone 2020 (renamed initiative Climat international), the first international initiative of the Private Equity industry focused on working towards achieving the objectives of the Paris Agreement.

By working with Eurazeo, Societe Generale is reaffirming its long-term commitment to supporting the energy transition and looks forward to supporting current and prospective new clients in meeting their own reduction emissions targets.