Backing a record UK investment to spark an electricity superhighway

Societe Generale co-arranged and structured the USD 1.054 billion financing to support National Grid Electricity Transmission plc (NGET)’s share in the construction of the Eastern Green Link 2 (EGL2) project in the UK. It is part of the UK Government’s Net Zero strategy and the country’s largest-ever investment in electricity transmission. The project is also a key component of National Grid’s plan to accelerate the decarbonisation of the country’s electricity network.

The EGL2 project: connecting wind power from Scotland to over two million English homes

NGET is responsible for owning and maintaining the high-voltage electricity transmission network across England and Wales. The company plays a vital role in delivering energy to millions of people in the UK, while actively supporting the country’s Net Zero goals by integrating low-carbon electricity into its network.

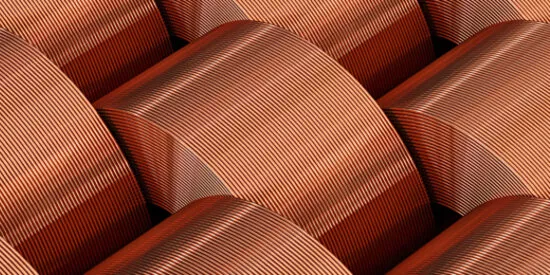

The EGL2 project will transmit up to 2GW of renewable energy from the Scottish wind farms to the rest of England via a 505 km subsea cable across the North Sea, enough to power over two million homes. With the high current direct voltage technology, it will scale up the UK’s capacity to transport home produced clean energy, and by doing so, it will increase the security, resilience, and stability of the country’s transmission network.

Supporting an unprecedented large-scale investment in the UK with a strong and flexible support from the Swedish export system

EGL2 is the largest investment in the UK’s electricity transmission system to date. Societe Generale acted as Joint Global Coordinator, Joint Bookrunner, Joint Green Loan and ESG Coordinator, Joint Documentation bank, Mandated Lead Arranger and Original Lender in this USD 1.054 billion Green financing, 95% covered by the Swedish ECA EKN. EKN supported not only the delivery by Hitachi of convertor stations produced in Sweden, but also part of both the cables provided by a third-party supplier and the local content under a flexible approach. The latter is structured as a Green loan for a project aligned with the EU Taxonomy and benefited from the issuance of the first EKN Green guarantee. The EKN facility has been transferred shortly after signing to Svensk Exportkredit (SEK), enabling National Grid to benefit from the Commercial Interest Reference Rate and thus secure a fixed interest rate during the 20 years door to door tenor of the EKN facility.

The green classification of EGL2, combined with Swedish content and EKN’s flexibility, enabled us to structure a significant ECA-backed facility. This not only supports National Grid’s net-zero ambitions but also provides a robust diversification tool for a sophisticated borrower seeking innovative financing solutions.

It is highly rewarding to contribute to a transaction that demonstrates how sustainable finance can enable large-scale investments in the green transition. This is one of EKN’s first and largest Green Export Credit Guarantees, and we are proud to support investment grade lending that advances the UK’s path towards Net Zero.

Transmission System Operators (TSO) in Europe are facing enormous investment challenges that may be difficult to fund solely on the commercial capital market, and SEK is proud to support Swedish exporters and their technologies in these projects together with our partner banks.

The UK’s Net Zero Strategy has ambitious targets which will require vast amounts of new renewable generation. Electricity will be the backbone of the entire energy system. Our pioneering HVDC technology will ensure that this electricity will reliably and efficiently get where it’s needed most.