Corporate Hybrid Bonds: a strategic tool in constant evolution

Corporate hybrid bonds, positioned halfway between debt and equity, attract both issuers and investors thanks to their flexibility and yield on offer. While the European market has reached maturity, the United States and Asia are now catching up, driven by recent methodological developments. A closer look at a segment undergoing continuous transformation.

By Julien Brune, Head of Debt Capital Markets Solutions and Advisory at Societe Generale.

By Julien Brune, Head of Debt Capital Markets Solutions and Advisory at Societe Generale.

Article published in "La Lettre du Trésorier" of the Association Française des Trésoriers d'Entreprise (French Association of Corporate Treasurers): Le trésorier et la crédibilité financière | AFTE

Corporate hybrid bonds(1) constitute a distinct category of bonds issued on the market by non-financial companies, mostly rated in the “investment grade” (“IG”) category(2). Their unique structure allows them to connect the dots: although legally considered debt, they are partially or fully recognised as equity—both in the issuers’ IFRS(3) financial statements and by rating agencies (typically up to 50%). This allows issuers to strengthen their financial structure without relying on dilutive capital calls.

These bond instruments have equity-type features: subordination in case of default, very long or even perpetual maturity, and optional coupon payments.

Financial flexibility and attractive yield

Issuers use hybrids to preserve or improve their credit rating, particularly in contexts of high CAPEX or external growth. Historically, the utilities and telecom sectors have been the most active, but the market has gradually diversified (real estate, transport, energy, etc.). Hybrid markets remain especially attractive for companies that cannot or do not wish to access equity markets, such as unlisted firms or those with public ownership.

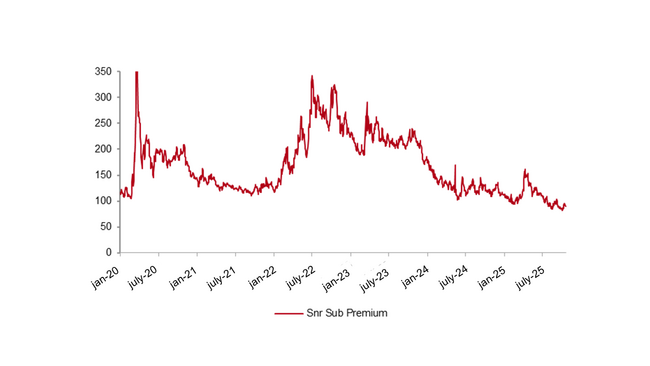

For investors, these instruments offer a higher yield than traditional senior bonds from the same issuer, in exchange for increased structural risk. The subordination premium—the additional yield required for a hybrid compared to a senior bond—has historically ranged between 100 and 300 basis points. However, current hunt for yield has compressed this premium to historically low levels: 70 basis points, for example, on recent deals from Danone or Alliander, and more broadly to record lows for frequent issuers (127 basis points for EDF’s latest green hybrid issuance in late September).

Toward greater agility

Long concentrated in Europe, the hybrid bond market is becoming increasingly international. In 2024, Moody’s relaxed its eligibility criteria, paving the way for a new generation of “light” hybrids: instruments that are simply subordinated, dated (30 years or more), but still recognised as 50% equity, with a reduced rating denotch compared to senior debt (one notch instead of the typical two).

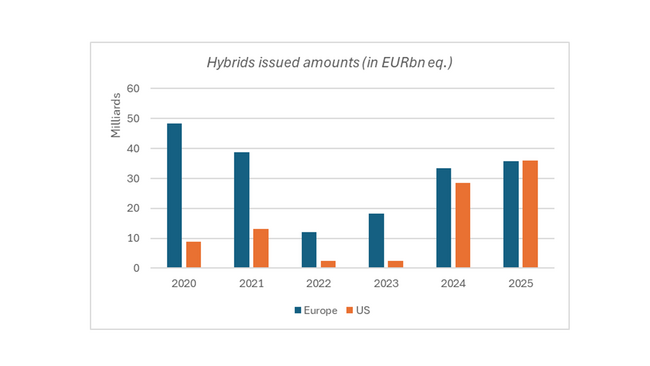

This shift was crucial for American issuers, previously held back by tax and accounting constraints. As a result, U.S. issuance jumped from 2–3 billion dollars per year to over 30 billion in 2024, nearly matching Europe’s annual volume. By the end of September 2025, the American market had already surpassed 27 billion dollars. And more recently, U.S. companies have turned to offshore markets, such as Verizon (EUR 2.25bn + GBP 1bn) and NextEra Energy (2 × EUR 1.25bn), which carried out large reverse Yankee hybrid issuances on the European market in November.

Other methodological adjustments have also benefited issuers rated in the speculative category (“non-IG”). This is how Czech real estate company CPI Property Group refinanced its existing hybrids with a more efficient structure, recognized as 100% equity by Moody’s. Others may follow this path.

Decrease in subordination premiums - Source: Bloomberg, Societe Generale Coroporate & Investment Banking

Outlook 2025–2026: stability in Europe, growth elsewhere

Due to quantitative limits imposed or self-imposed in corporate capital structures, the hybrid bond market is not expected to grow indefinitely. In Europe, it has been firmly established for about fifteen years and it is now mature. For the full year 2025, issuance is expected to reach between 30 and 35 billion euros, in line with previous years, and much of the refinancings planned for 2026 have already been anticipated. Still, the currently attractive issuance conditions may encourage some issuers to tap the market opportunistically.

Meanwhile, momentum is clearly rising outside Europe. Issuance in the U.S. is expected to continue growing, driven by utilities’ investment needs and facilitated by methodological adjustments. Asia is also opening up to this market: recent examples include MTR Corp in Hong Kong and Japan Tobacco in Japan. These regions will be the next growth drivers of a constantly evolving market.

American companies are joining the game - Source: Bloomberg, Societe Generale Coroporate & Investment Banking

(1) Not to be confused with convertible bonds, which are bonds which carry an equity conversion option.

(2) A financial rating category assigned to debt instruments (such as bonds) considered to carry low default risk.

(3) International Financial Reporting Standards